With a market cap of $22.1 billion, Dollar General Corporation (DG) is a leading discount retailer in the United States, offering a wide range of low-priced merchandise across consumables, seasonal items, home products, and apparel. The company serves customers primarily in the southern, southwestern, midwestern, and eastern regions of the U.S.

Shares of the Goodlettsville, Tennessee-based company have outperformed the broader market over the past 52 weeks. DG stock has increased 30.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained nearly 14%. Moreover, shares of the company have soared 32.4% on a YTD basis, compared to SPX’s 16.2% increase.

Narrowing the focus, shares of the discount retailer have surpassed the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.4% decrease over the past 52 weeks and 2.8% drop on a YTD basis.

Dollar General’s shares rose marginally on Aug. 28 after the company reported Q2 2025 EPS of $1.86 and revenue of $10.73 billion, exceeding forecasts. The retailer also raised its annual EPS forecast to $5.80 - $6.30 and upgraded its 2025 net sales growth outlook to 4.3% - 4.8%, reflecting confidence in its same-day delivery partnerships and store remodel initiatives.

For the fiscal year ending in January 2026, analysts expect Dollar General’s EPS to grow 3.6% year-over-year to $6.13. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

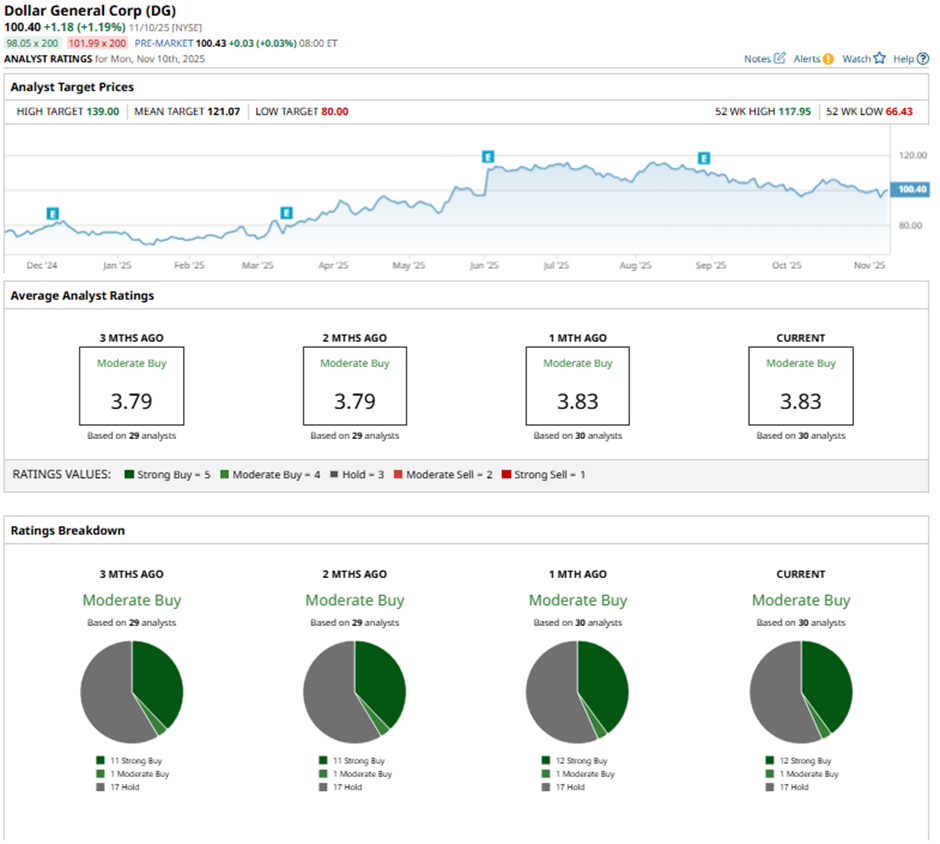

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and 17 “Holds.”

This configuration is slightly more bullish than it was three months ago, when DG had 11 “Strong Buys” in total.

On Oct. 27, JPMorgan analyst Matthew Boss raised Dollar General’s price target to $115 and maintained a “Neutral” rating.

The mean price target of $121.07 represents a 20.6% premium to DG’s current price levels. The Street-high price target of $139 suggests a 38.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart