Let’s dig into the relative performance of WD-40 (NASDAQ:WDFC) and its peers as we unravel the now-completed Q4 consumer staples earnings season.

The consumer staples industry comprises companies engaged in the manufacturing, distribution, and sale of essential, everyday products. These products, also known as "staples," are fundamental to daily living and include packaged food, beverages and alcohol, personal care, and household products. Consumer staples stocks are considered defensive investments because consumers often purchase them regardless of economic conditions. To stand out, companies must have some combination of brand recognition, product quality, and price competitiveness.

The 8 consumer staples stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.9%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.4% since the latest earnings results.

WD-40 (NASDAQ:WDFC)

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

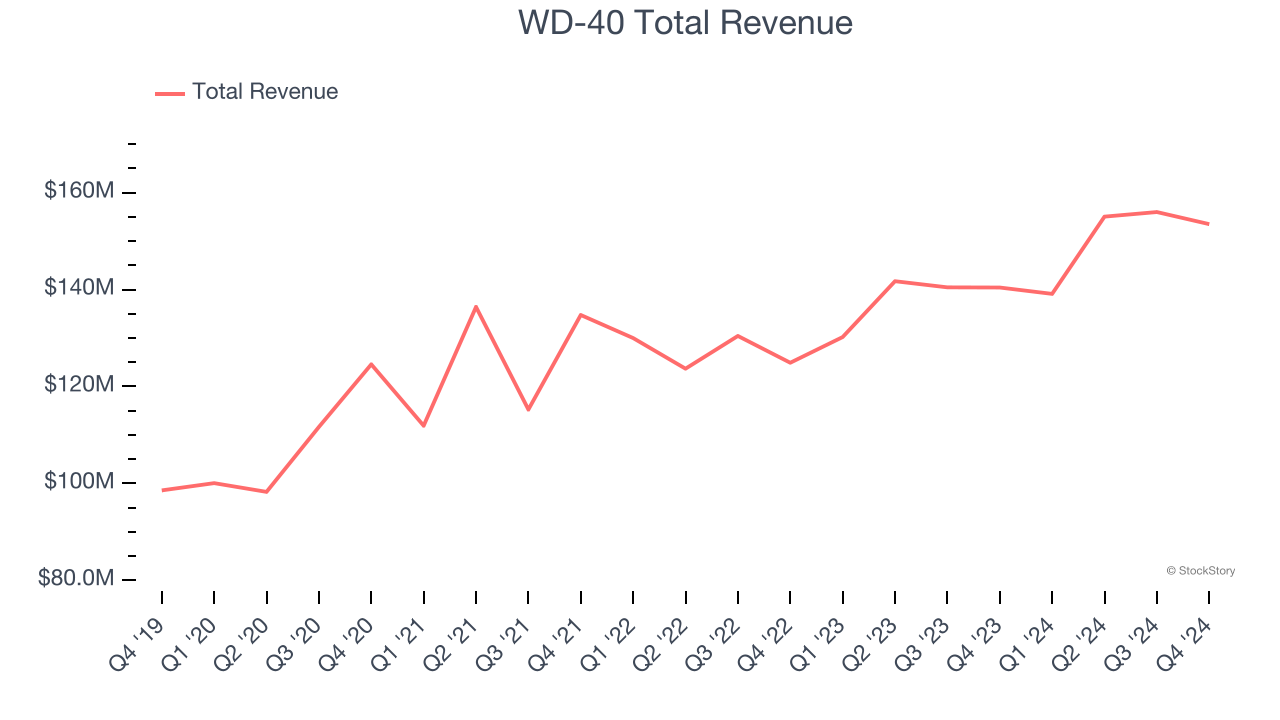

WD-40 reported revenues of $153.5 million, up 9.3% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ EPS estimates but full-year revenue guidance slightly missing analysts’ expectations.

“In the first quarter, we executed well against our strategic priorities, with strong growth across multiple regions including the United States, Latin America, and EIMEA,” said Steve Brass, WD-40 Company's president and chief executive officer.

The stock is down 7.3% since reporting and currently trades at $223.37.

Is now the time to buy WD-40? Access our full analysis of the earnings results here, it’s free.

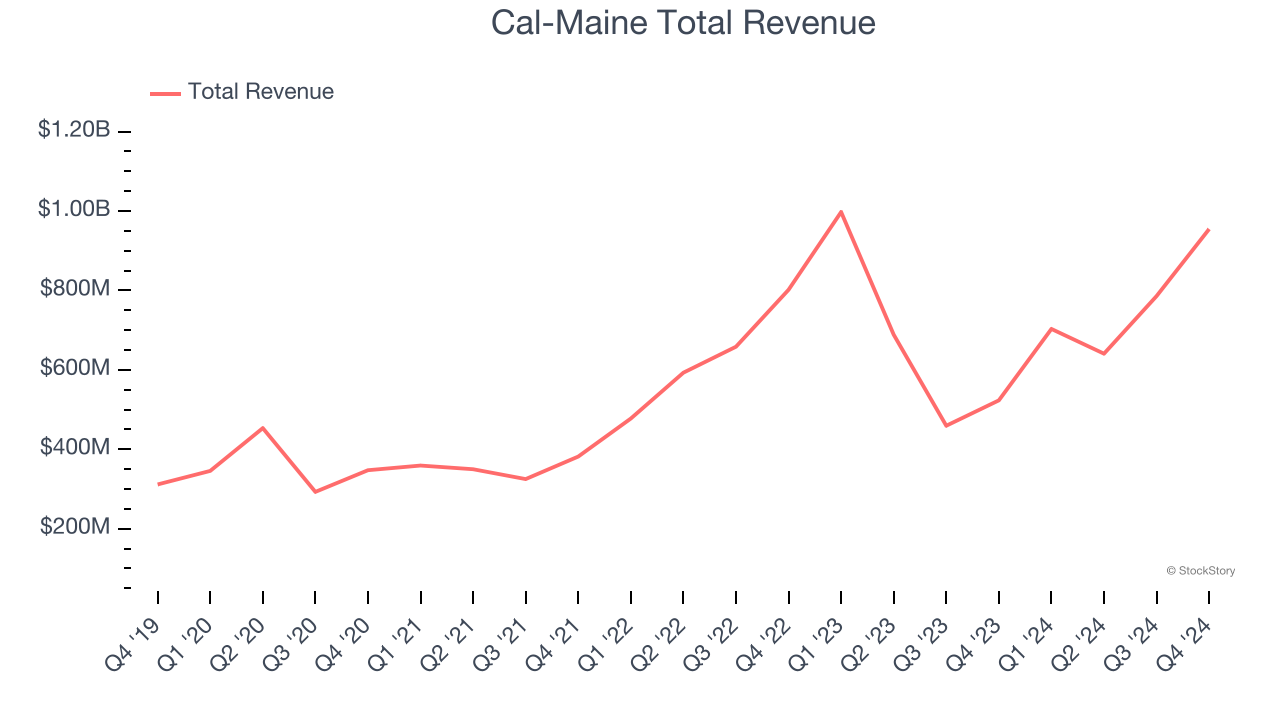

Best Q4: Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $954.7 million, up 82.5% year on year, outperforming analysts’ expectations by 27%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Cal-Maine achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 3.2% since reporting. It currently trades at $107.

Is now the time to buy Cal-Maine? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.60 billion, down 7.6% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Lamb Weston delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 22.1% since the results and currently trades at $60.85.

Read our full analysis of Lamb Weston’s results here.

Tilray (NASDAQ:TLRY)

Founded in 2013, Tilray Brands (NASDAQ:TLRY) engages in in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

Tilray reported revenues of $211 million, up 8.9% year on year. This print came in 2.5% below analysts' expectations. Overall, it was a slower quarter as it also logged a significant miss of analysts’ adjusted operating income estimates.

Tilray delivered the highest full-year guidance raise among its peers. The stock is down 13.5% since reporting and currently trades at $1.19.

Read our full, actionable report on Tilray here, it’s free.

Conagra (NYSE:CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE:CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $3.20 billion, flat year on year. This result beat analysts’ expectations by 1.5%. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ organic revenue estimates but full-year EPS guidance missing analysts’ expectations.

The stock is down 3.2% since reporting and currently trades at $26.48.

Read our full, actionable report on Conagra here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.