Over the past six months, BWX has been a great trade, beating the S&P 500 by 8%. Its stock price has climbed to $111.07, representing a healthy 12.1% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in BWX, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re happy investors have made money, but we don't have much confidence in BWX. Here are three reasons why we avoid BWXT and a stock we'd rather own.

Why Is BWX Not Exciting?

Contributing components and materials to the famous Manhattan Project in the 1940s, BWX (NYSE:BWXT) is a manufacturer and service provider of nuclear components and fuel for government and commercial industries.

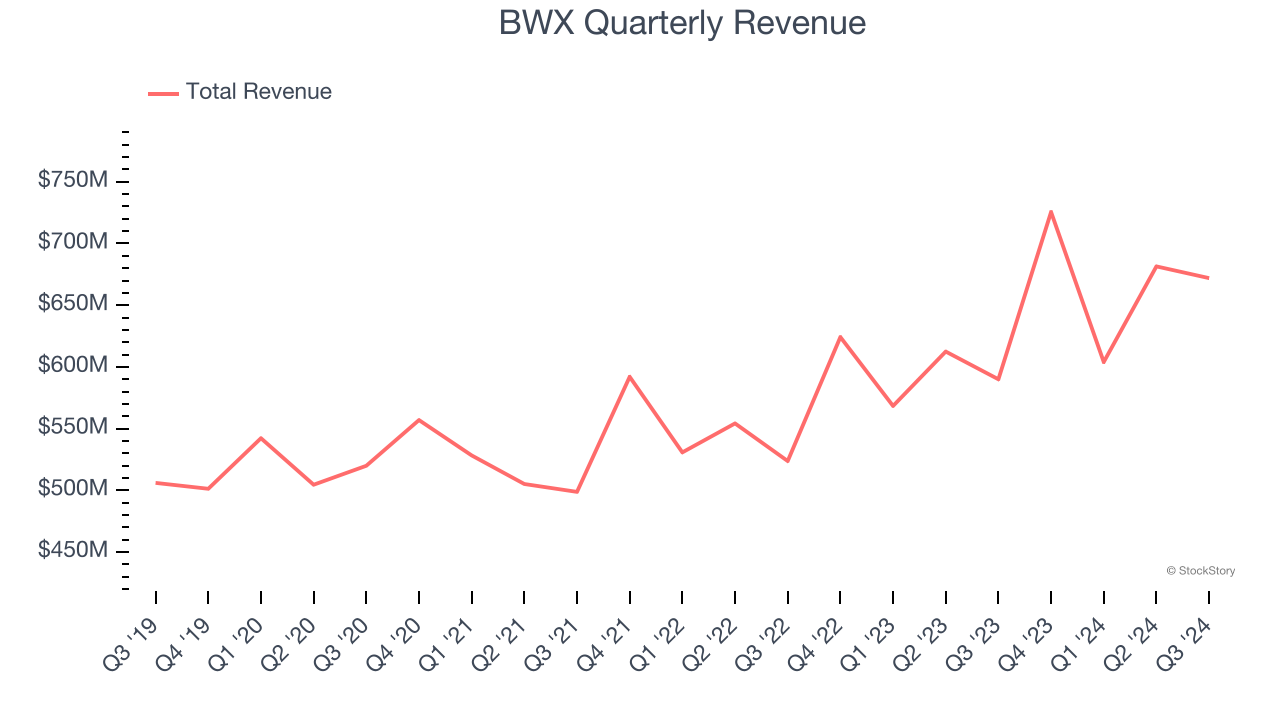

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, BWX grew its sales at a mediocre 7.5% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

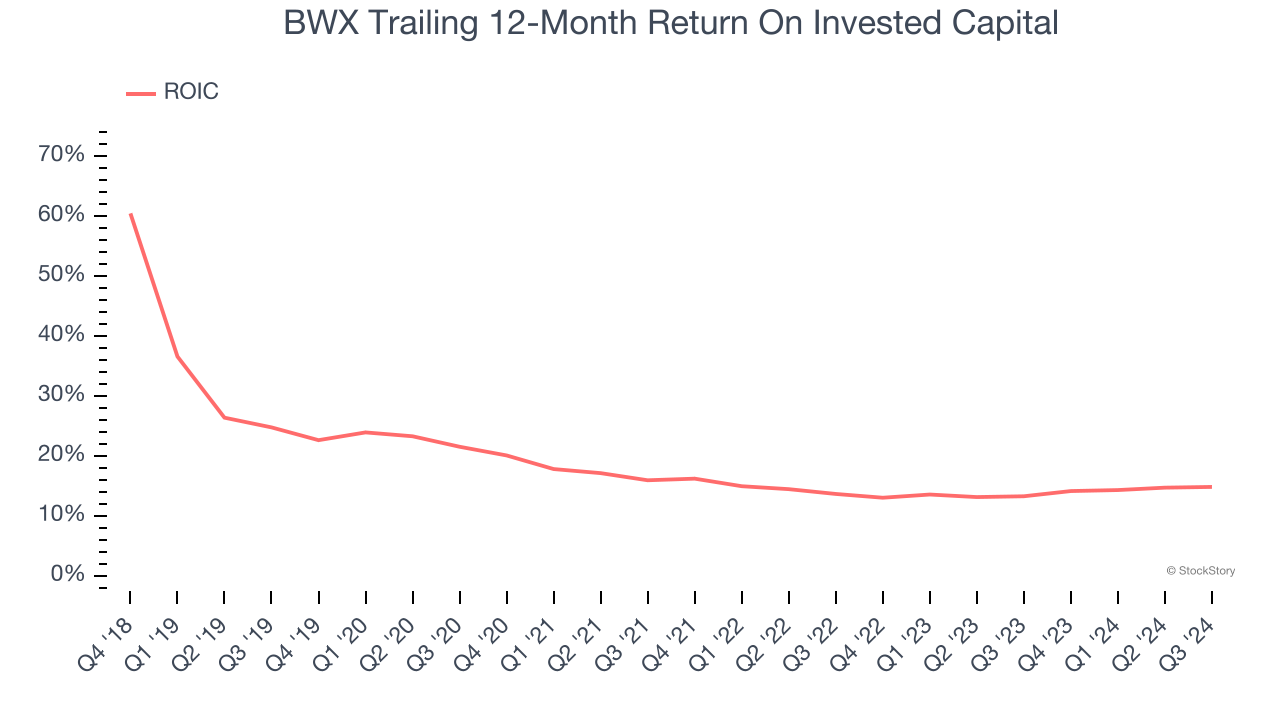

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. On average, BWX’s ROIC decreased by 4.7 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect BWX’s revenue to rise by 1.7%, a deceleration versus its 10.4% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Final Judgment

BWX’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 34.8× forward price-to-earnings (or $111.07 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than BWX

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.