SolarEdge’s stock price has taken a beating over the past six months, shedding 45.2% of its value and falling to $14.69 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in SolarEdge, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in SolarEdge. Here are three reasons why we avoid SEDG and a stock we'd rather own.

Why Do We Think SolarEdge Will Underperform?

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

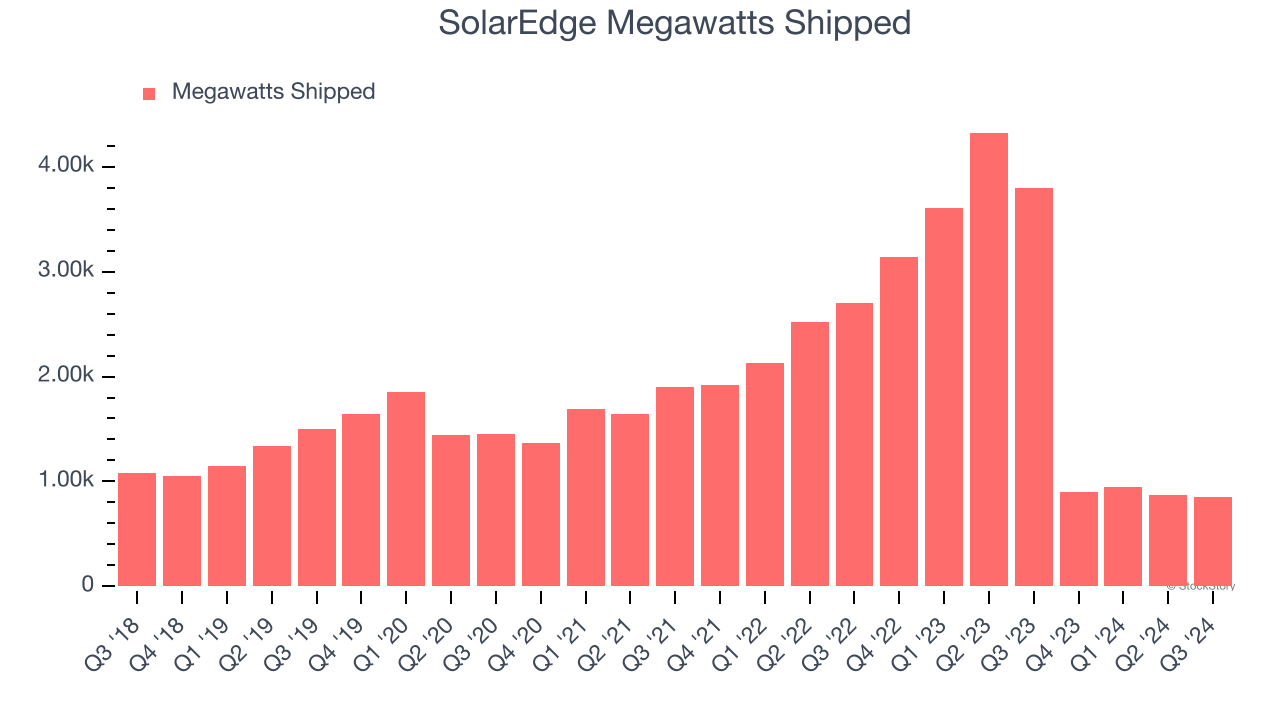

1. Decline in Megawatts Shipped Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like SolarEdge, our preferred volume metric is megawatts shipped). While both are important, the latter is the most critical to analyze because prices have a ceiling.

SolarEdge’s megawatts shipped came in at 850 in the latest quarter, and over the last two years, averaged 7.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests SolarEdge might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

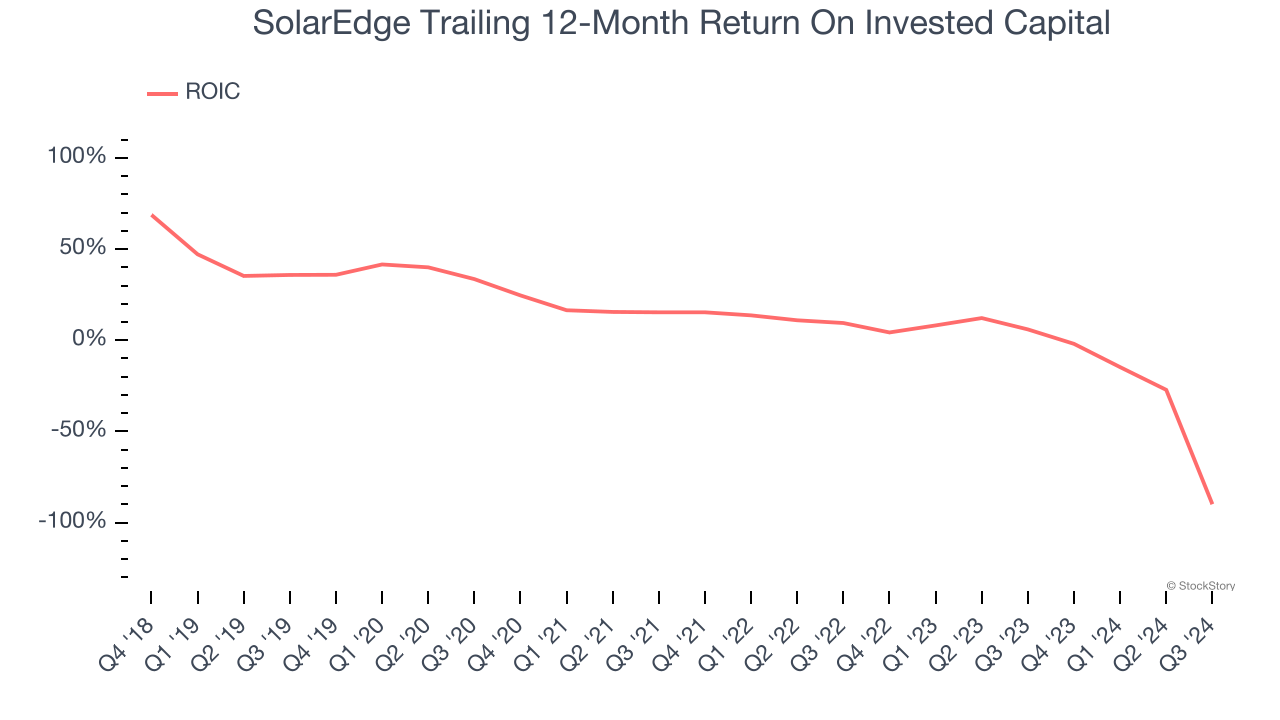

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, SolarEdge’s ROIC has decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

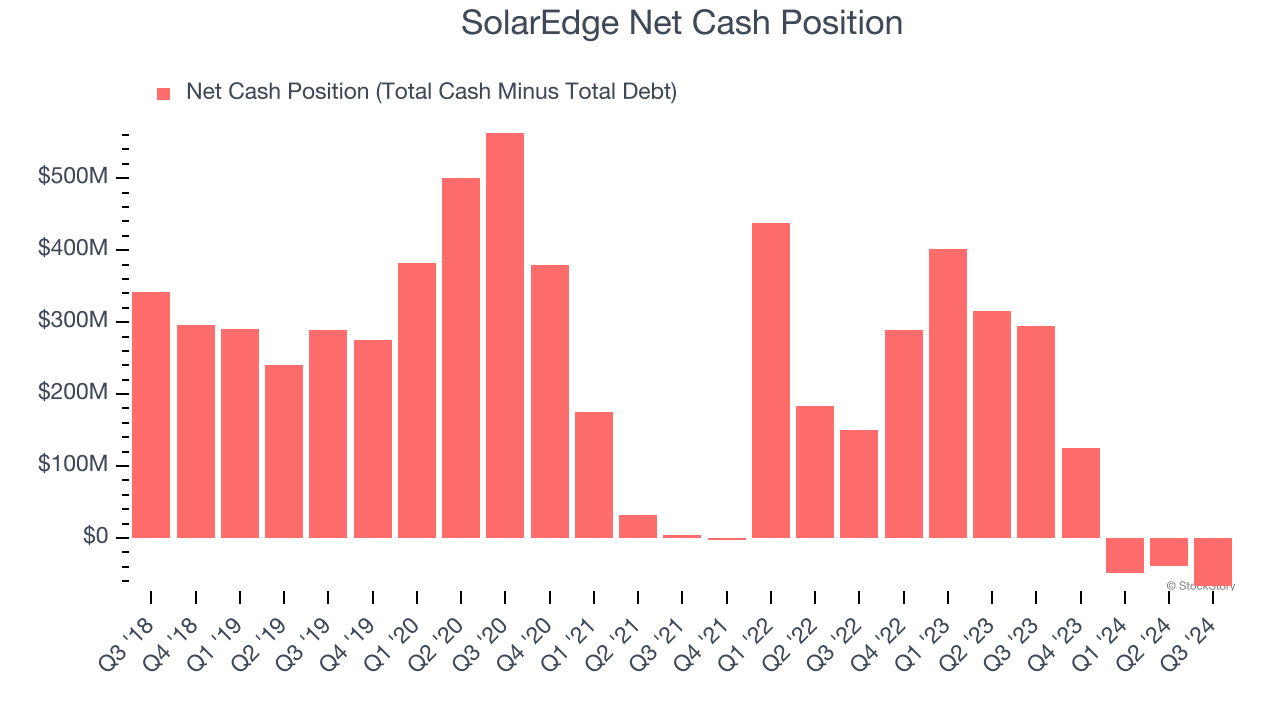

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

SolarEdge burned through $602 million of cash over the last year, and its $746 million of debt exceeds the $678.8 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the SolarEdge’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of SolarEdge until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

SolarEdge falls short of our quality standards. After the recent drawdown, the stock trades at $14.69 per share (or 0.5× forward price-to-sales). The market typically values companies like SolarEdge based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at Meta, a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of SolarEdge

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.