Over the past six months, TreeHouse Foods’s shares (currently trading at $33.40) have posted a disappointing 11.6% loss, well below the S&P 500’s 4.2% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy TreeHouse Foods, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're cautious about TreeHouse Foods. Here are three reasons why THS doesn't excite us and a stock we'd rather own.

Why Do We Think TreeHouse Foods Will Underperform?

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE:THS) produces a wide range of private-label foods for grocery and food service customers.

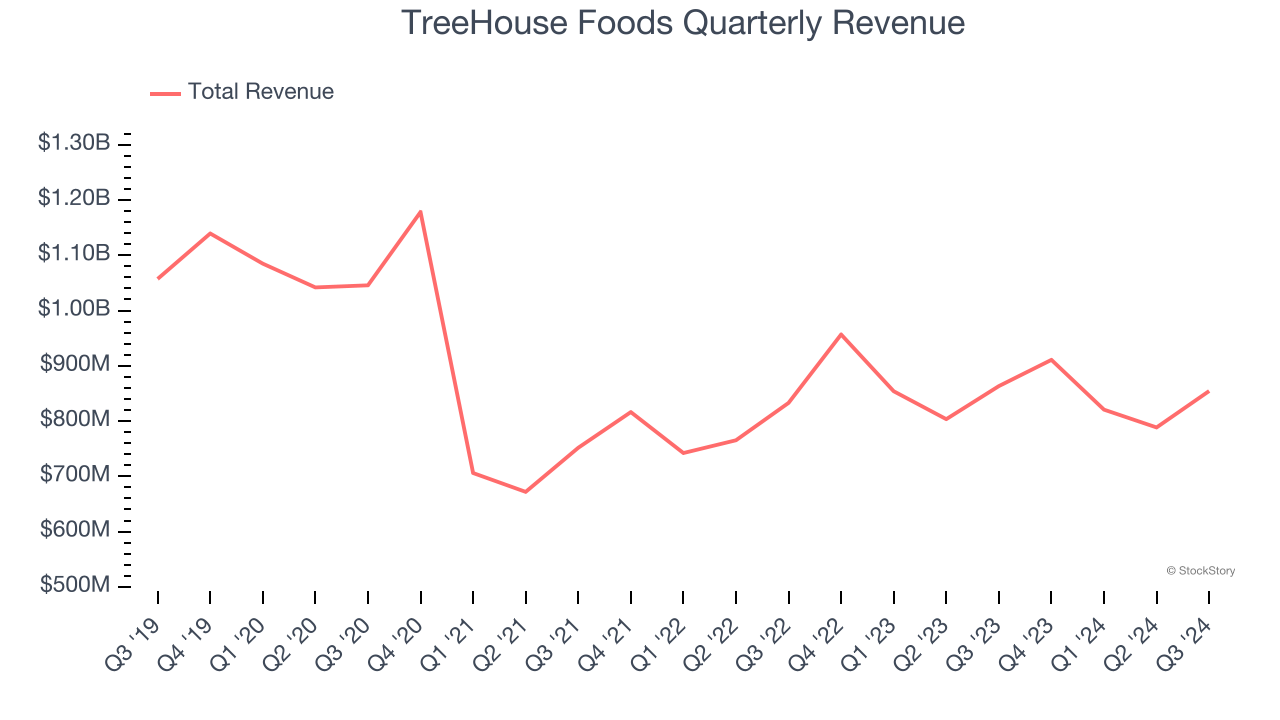

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, TreeHouse Foods struggled to consistently increase demand as its $3.37 billion of sales for the trailing 12 months was close to its revenue three years ago. This fell short of our benchmarks and signals it’s a low quality business.

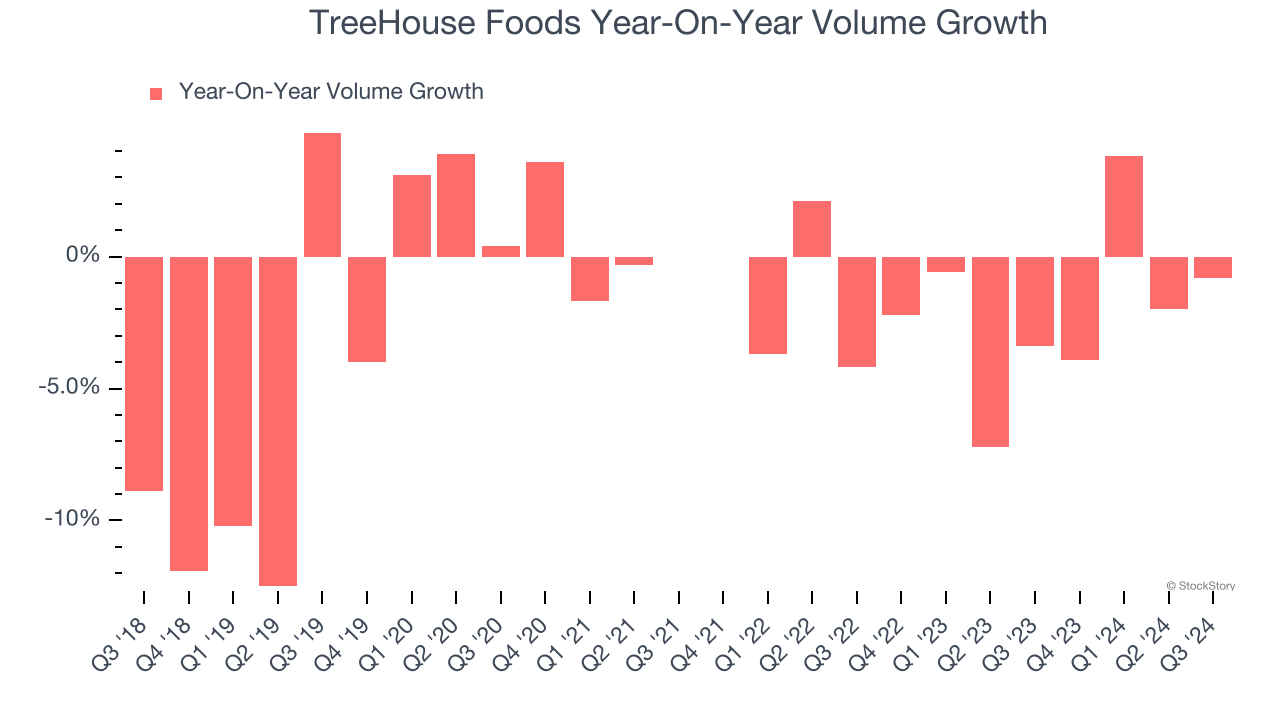

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

TreeHouse Foods’s average quarterly sales volumes have shrunk by 2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

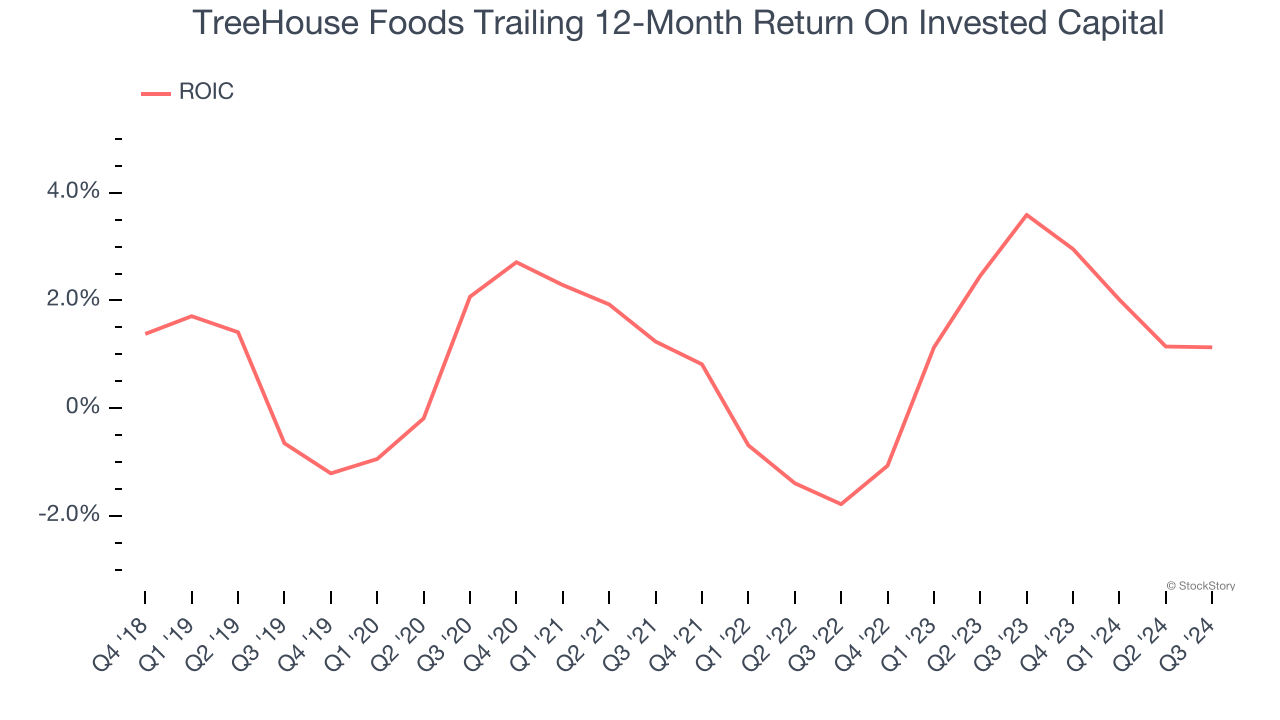

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

TreeHouse Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of TreeHouse Foods, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 11× forward price-to-earnings (or $33.40 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. We’d suggest looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than TreeHouse Foods

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.