Over the past six months, Trimble has been a great trade, beating the S&P 500 by 16.8%. Its stock price has climbed to $69.30, representing a healthy 21% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Trimble, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re glad investors have benefited from the price increase, but we're swiping left on Trimble for now. Here are three reasons why we avoid TRMB and a stock we'd rather own.

Why Do We Think Trimble Will Underperform?

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ:TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

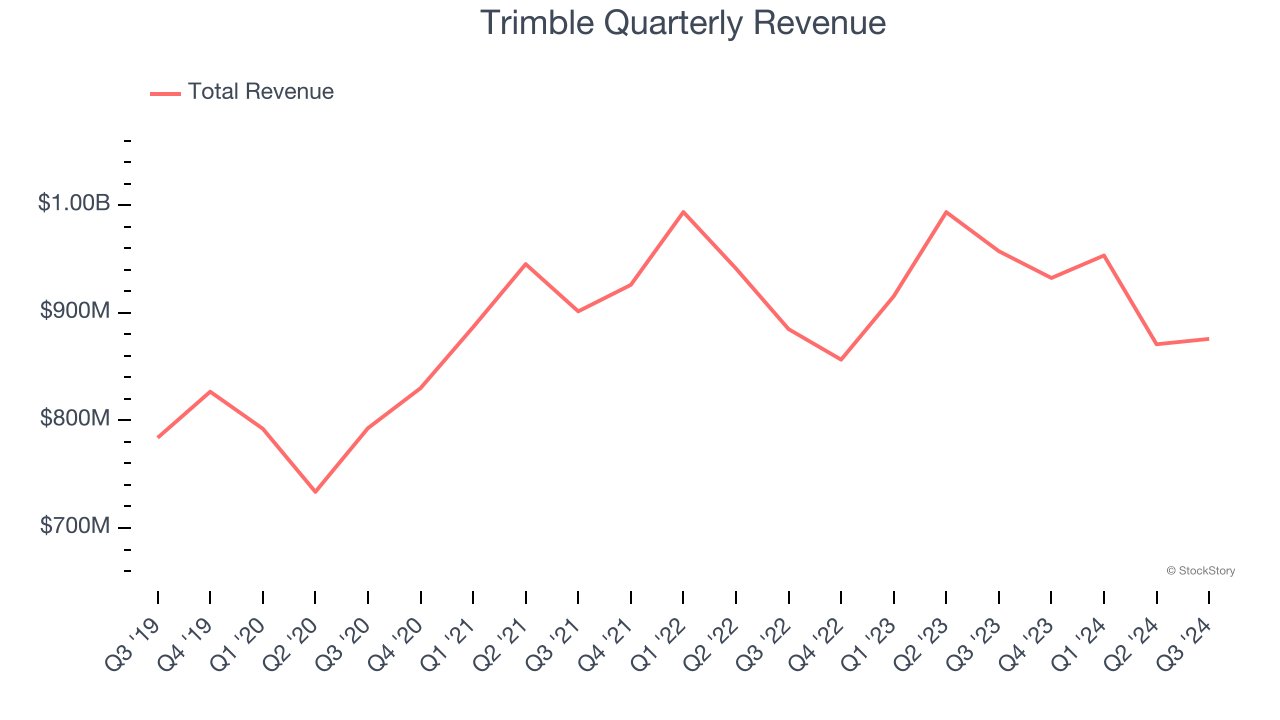

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Trimble grew its sales at a sluggish 2.4% compounded annual growth rate. This was below our standards.

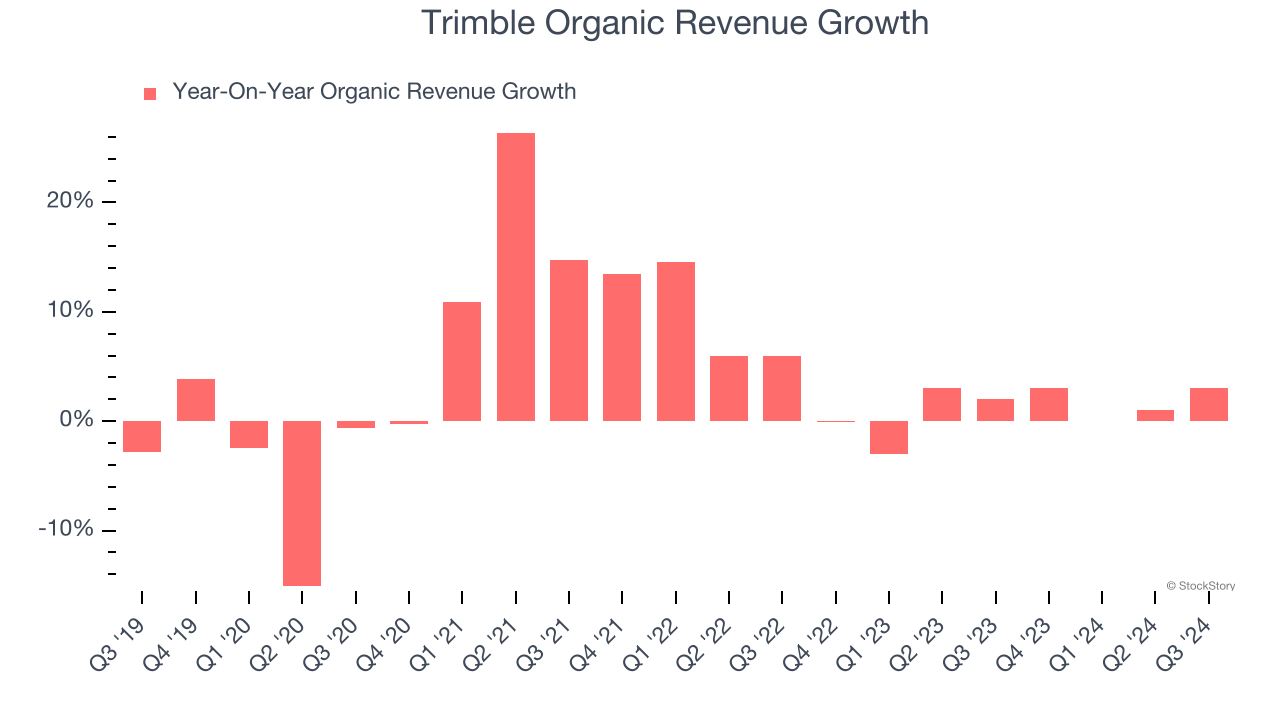

2. Slow Organic Growth Suggests Waning Demand In Core Business

Investors interested in Internet of Things companies should track organic revenue in addition to reported revenue. This metric gives visibility into Trimble’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Trimble’s organic revenue averaged 1.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

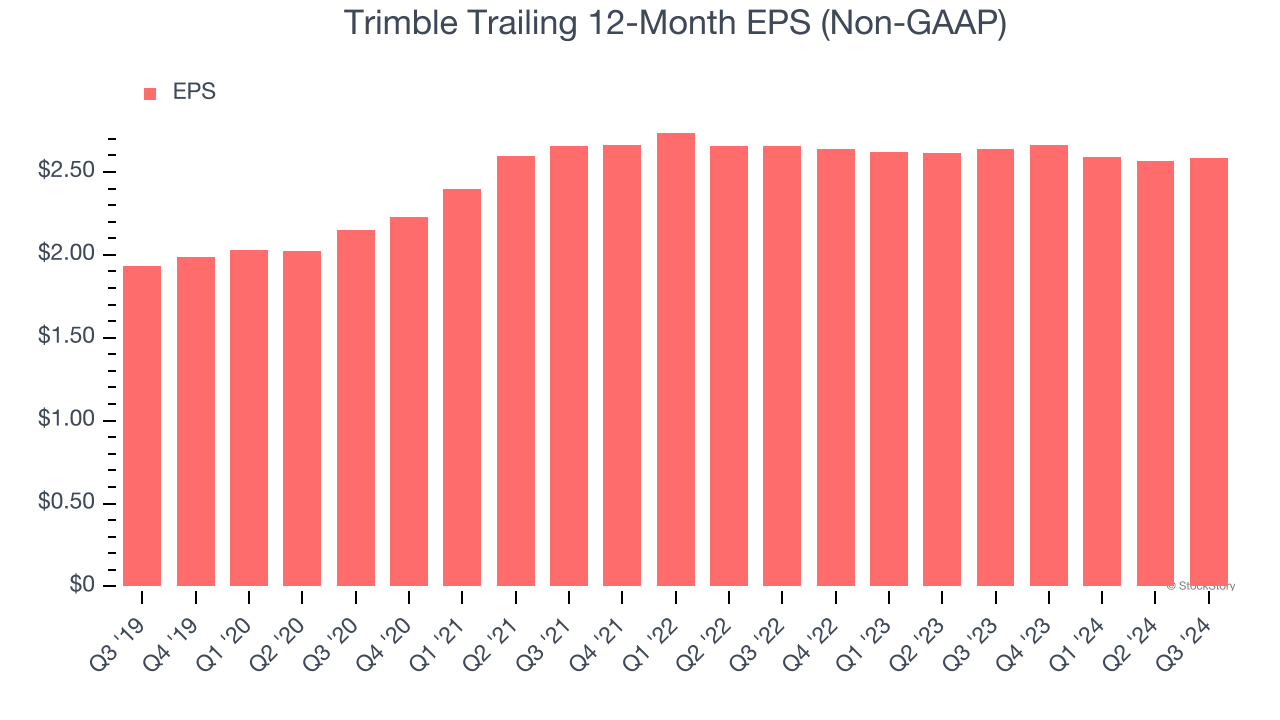

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Trimble’s EPS grew at an unimpressive 5.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Trimble, we’ll be cheering from the sidelines. With its shares beating the market recently, the stock trades at 23.4× forward price-to-earnings (or $69.30 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Would Buy Instead of Trimble

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.