Over the last six months, Zeta’s shares have sunk to $17.33, producing a disappointing 9.5% loss - a stark contrast to the S&P 500’s 4.2% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Zeta, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about Zeta. Here are three reasons why there are better opportunities than ZETA and a stock we'd rather own.

Why Is Zeta Not Exciting?

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

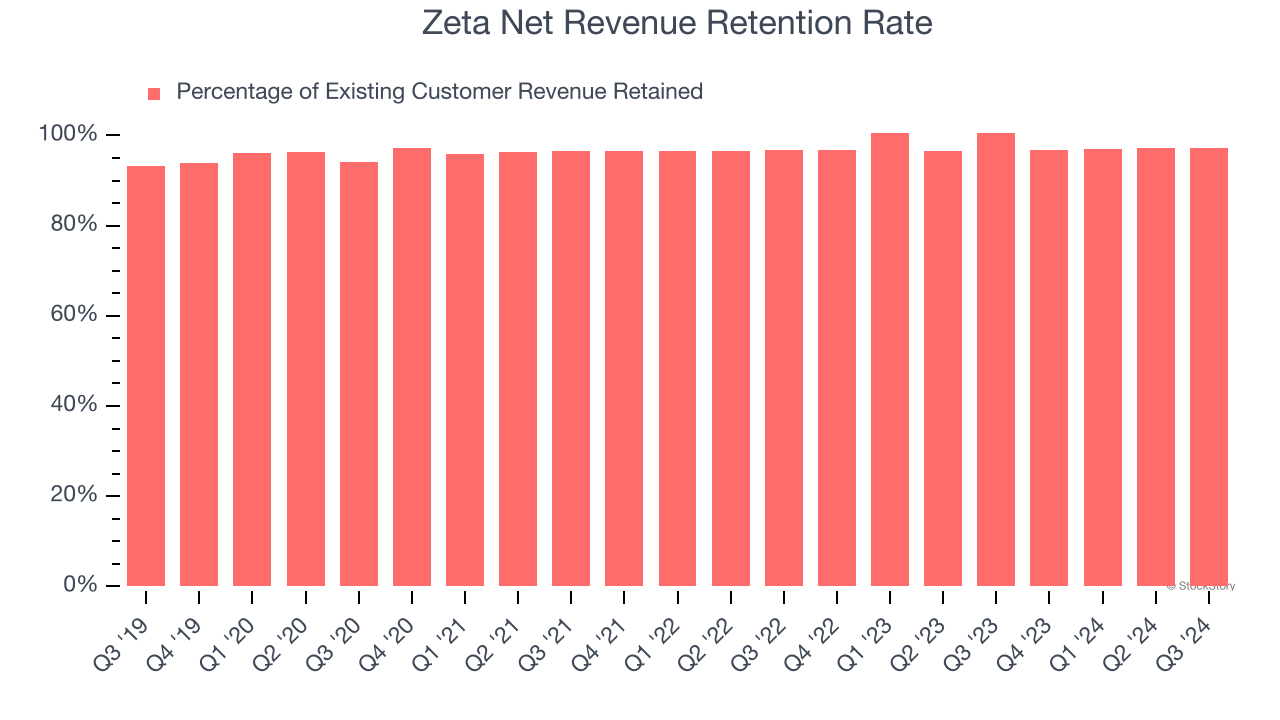

Zeta’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 97.1% in Q3. This means Zeta’s revenue would’ve decreased by 2.9% over the last 12 months if it didn’t win any new customers.

Zeta has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

2. Low Gross Margin Reveals Weak Structural Profitability

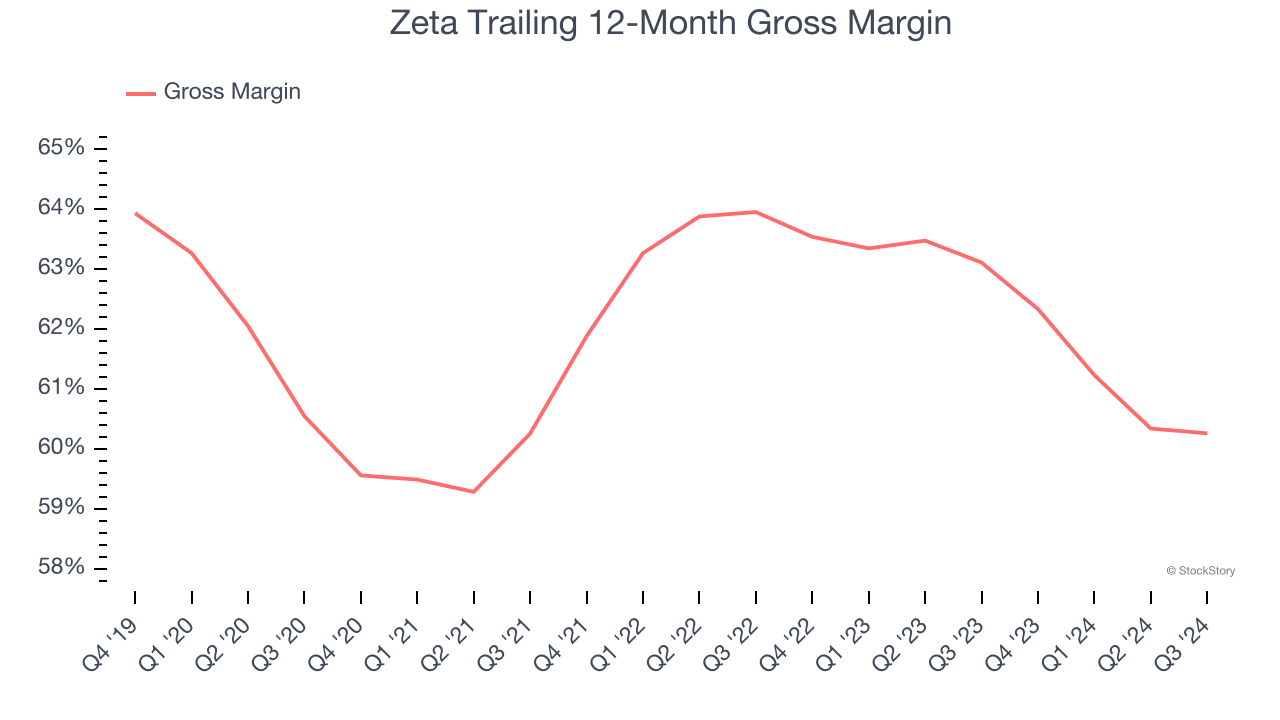

For software companies like Zeta, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Zeta’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.3% gross margin over the last year. Said differently, Zeta had to pay a chunky $39.74 to its service providers for every $100 in revenue.

3. Operating Losses Sound the Alarms

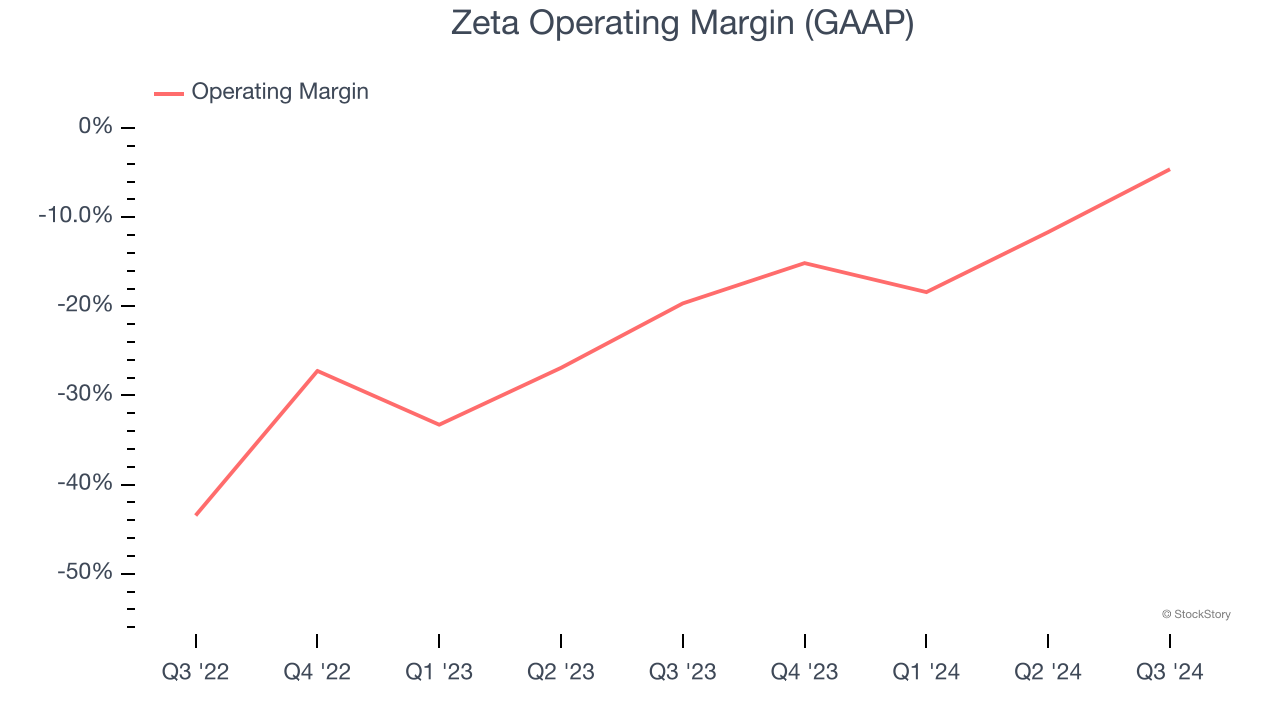

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Zeta’s expensive cost structure has contributed to an average operating margin of negative 11.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Zeta reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Final Judgment

Zeta isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 3× forward price-to-sales (or $17.33 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Zeta

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.