Burger restaurant chain Red Robin (NASDAQ:RRGB) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 3.5% year on year to $265.1 million. The company expects the full year’s revenue to be around $1.2 billion, close to analysts’ estimates. Its non-GAAP loss of $0.70 per share was 10% above analysts’ consensus estimates.

Is now the time to buy Red Robin? Find out by accessing our full research report, it’s free for active Edge members.

Red Robin (RRGB) Q3 CY2025 Highlights:

- Revenue: $265.1 million vs analyst estimates of $256.7 million (3.5% year-on-year decline, 3.3% beat)

- Adjusted EPS: -$0.70 vs analyst estimates of -$0.78 (10% beat)

- Adjusted EBITDA: $7.6 million vs analyst estimates of $4.41 million (2.9% margin, 72.3% beat)

- The company reconfirmed its revenue guidance for the full year of $1.2 billion at the midpoint

- EBITDA guidance for the full year is $65 million at the midpoint, above analyst estimates of $62.89 million

- Operating Margin: -4.6%, in line with the same quarter last year

- Same-Store Sales fell 1.2% year on year (0.6% in the same quarter last year)

- Market Capitalization: $84 million

Dave Pace, Red Robin's President and Chief Executive Officer said, "We began to quickly see results from our First Choice plan as our Big YUMMM promotion performed above expectations and helped deliver a sequential traffic improvement of approximately 250 basis points from the second quarter with particular resonance during mid-week dining and lunch dayparts."

Company Overview

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.23 billion in revenue over the past 12 months, Red Robin is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Red Robin struggled to generate demand over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 1.2% annually, a rough starting point for our analysis.

This quarter, Red Robin’s revenue fell by 3.5% year on year to $265.1 million but beat Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to decline by 5% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and suggests its menu offerings will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

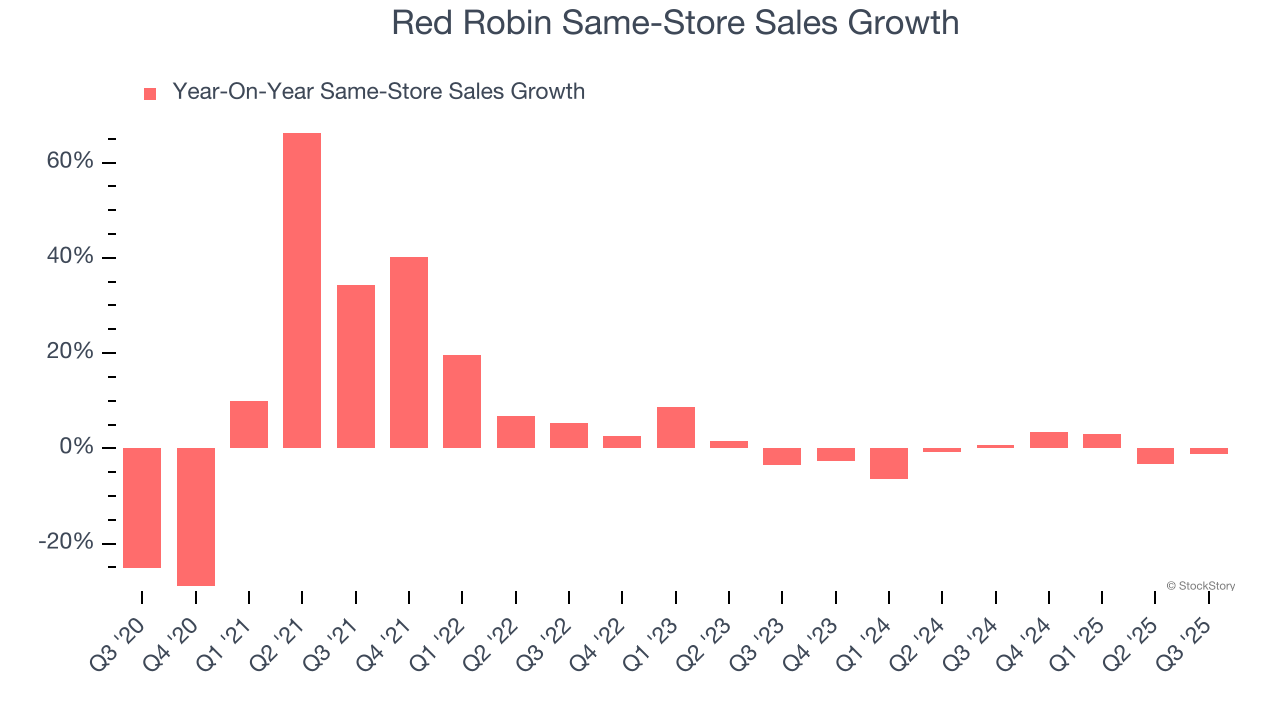

Same-Store Sales

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Red Robin’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat.

In the latest quarter, Red Robin’s same-store sales fell by 1.2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Red Robin’s Q3 Results

We were impressed by how significantly Red Robin blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 13.8% to $5.35 immediately following the results.

Red Robin may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.