Online used car auction platform ACV Auctions (NASDAQ:ACVA) met Wall Streets revenue expectations in Q3 CY2025, with sales up 16.5% year on year to $199.6 million. On the other hand, next quarter’s revenue guidance of $182 million was less impressive, coming in 4.9% below analysts’ estimates. Its GAAP loss of $0.14 per share was significantly below analysts’ consensus estimates.

Is now the time to buy ACV Auctions? Find out by accessing our full research report, it’s free for active Edge members.

ACV Auctions (ACVA) Q3 CY2025 Highlights:

- Revenue: $199.6 million vs analyst estimates of $200 million (16.5% year-on-year growth, in line)

- EPS (GAAP): -$0.14 vs analyst estimates of -$0.07 (significant miss)

- Adjusted EBITDA: $18.65 million vs analyst estimates of $18.81 million (9.3% margin, 0.8% miss)

- Revenue Guidance for Q4 CY2025 is $182 million at the midpoint, below analyst estimates of $191.5 million

- EBITDA guidance for the full year is $57 million at the midpoint, below analyst estimates of $68.56 million

- Operating Margin: -11.9%, down from -10% in the same quarter last year

- Free Cash Flow was -$1.25 million, down from $1.66 million in the previous quarter

- Marketplace Units: 218,065, up 19,711 year on year

- Market Capitalization: $1.54 billion

Company Overview

Founded in 2014, ACV Auctions (NASDAQ:ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

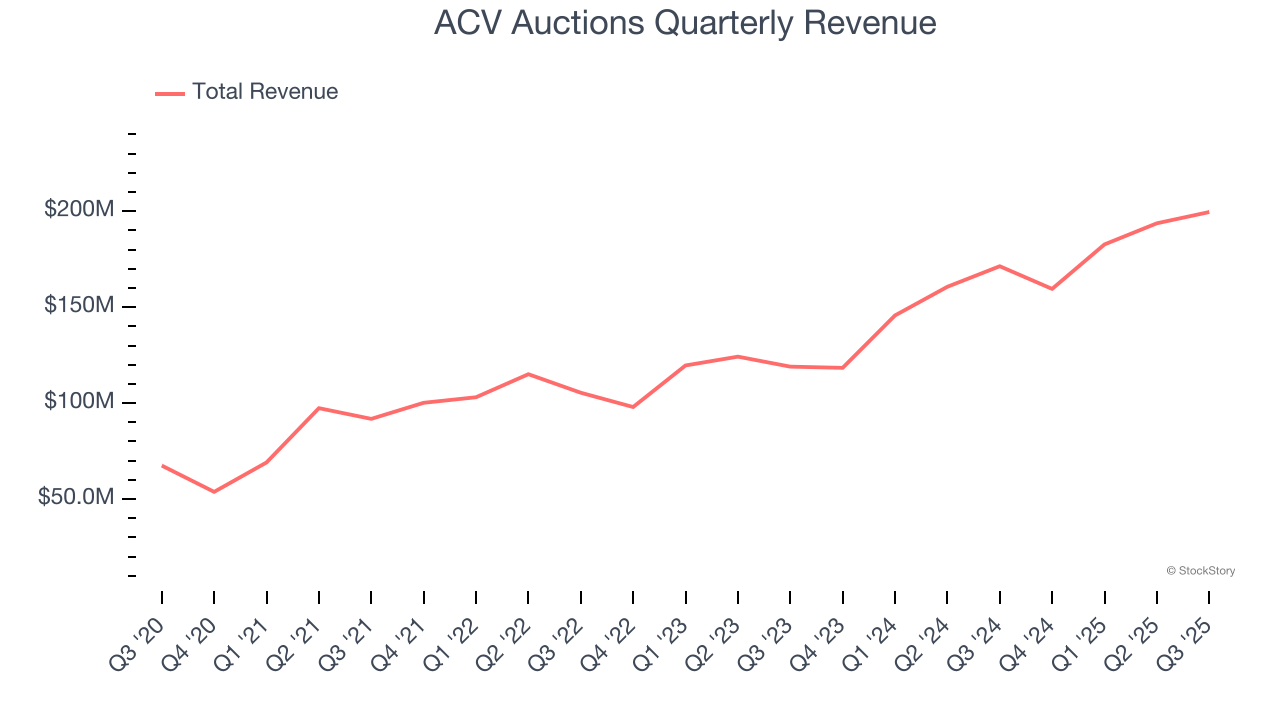

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, ACV Auctions’s sales grew at an impressive 20.2% compounded annual growth rate over the last three years. Its growth beat the average consumer internet company and shows its offerings resonate with customers.

This quarter, ACV Auctions’s year-on-year revenue growth was 16.5%, and its $199.6 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 14.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.2% over the next 12 months, similar to its three-year rate. This projection is commendable and suggests the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Marketplace Units

Unit Growth

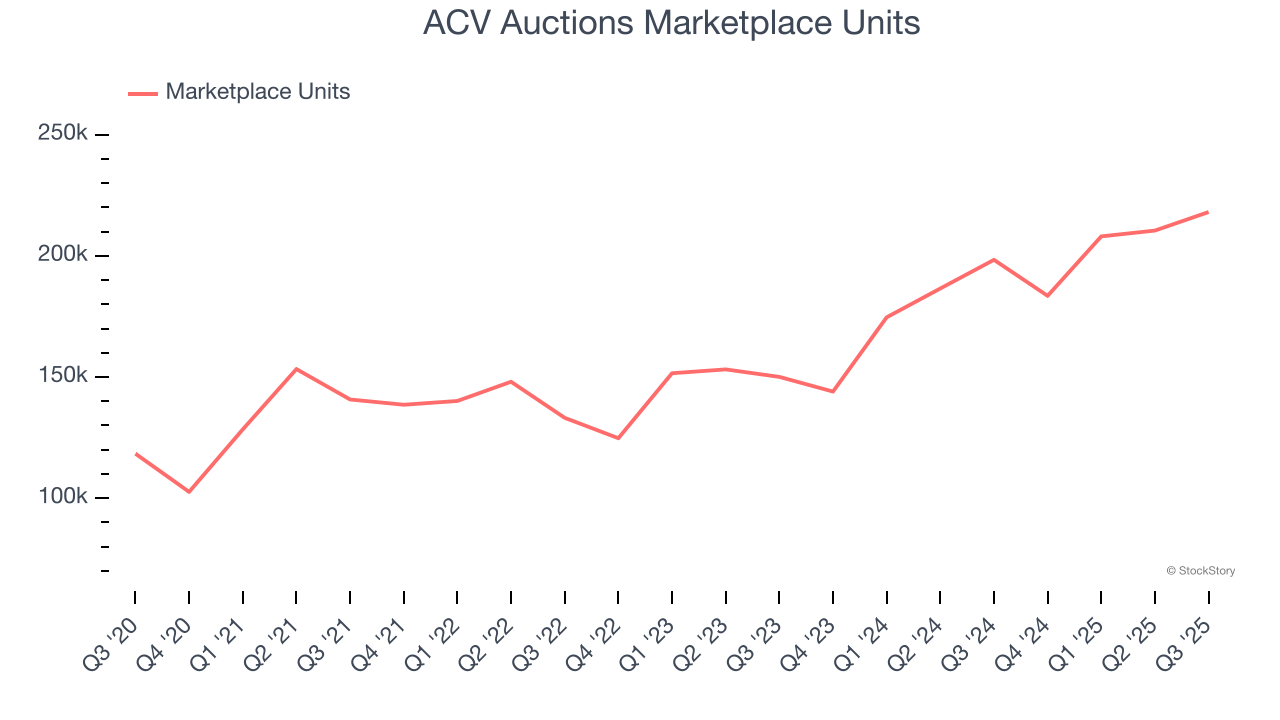

As an online marketplace, ACV Auctions generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, ACV Auctions’s marketplace units, a key performance metric for the company, increased by 19.2% annually to 218,065 in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q3, ACV Auctions added 19,711 marketplace units, leading to 9.9% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating unit growth just yet.

Revenue Per Unit

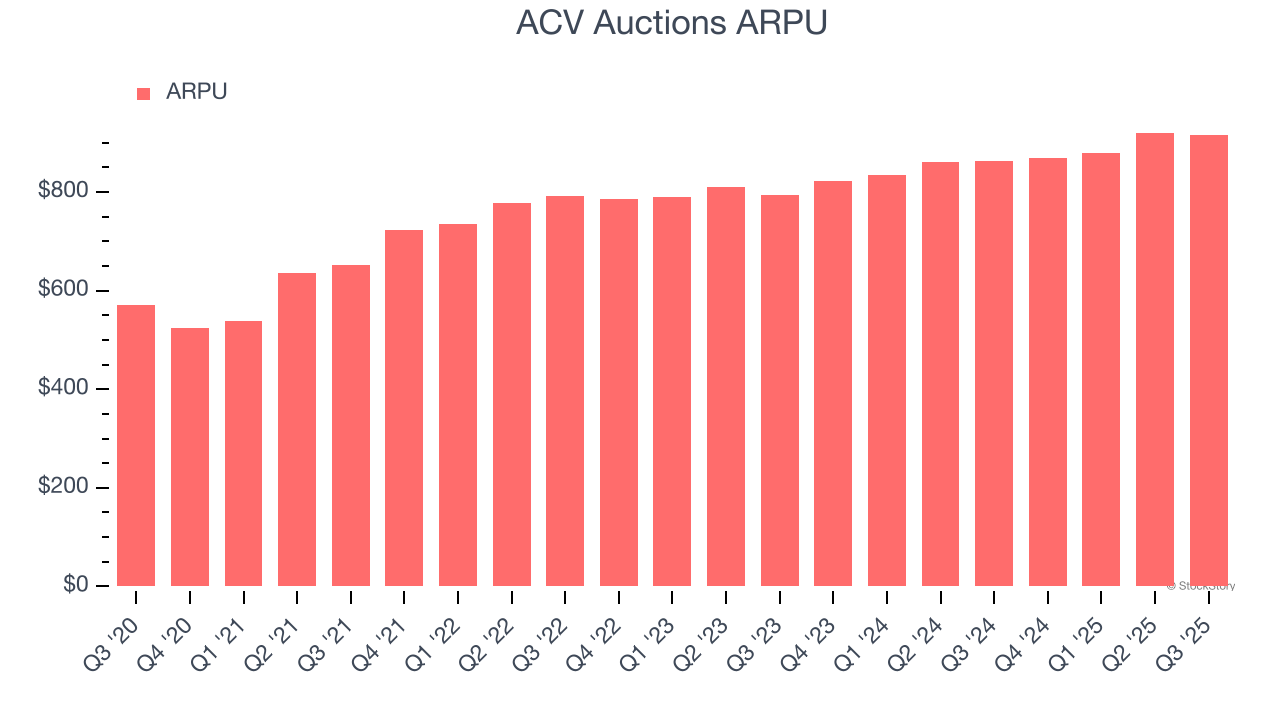

Average revenue per unit (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each unit. ARPU also gives us unique insights into a user’s average order size and ACV Auctions’s take rate, or "cut", on each order.

ACV Auctions’s ARPU growth has been strong over the last two years, averaging 6.2%. Its ability to increase monetization while quickly growing its marketplace units reflects the strength of its platform, as its units continue to spend more each year.

This quarter, ACV Auctions’s ARPU clocked in at $915.14. It grew by 5.9% year on year, slower than its unit growth.

Key Takeaways from ACV Auctions’s Q3 Results

It was good to see ACV Auctions increase its number of units this quarter. On the other hand, its full-year revenue guidance slightly missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 13.4% to $7.05 immediately after reporting.

ACV Auctions’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.