Pet insurance provider Trupanion (NASDAQ:TRUP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 12.1% year on year to $366.9 million. Its GAAP profit of $0.13 per share was 90.3% above analysts’ consensus estimates.

Is now the time to buy Trupanion? Find out by accessing our full research report, it’s free for active Edge members.

Trupanion (TRUP) Q3 CY2025 Highlights:

“We delivered record quarterly profitability while accelerating subscription pet growth for the third consecutive quarter,” said Margi Tooth, Chief Executive Officer and President of Trupanion.

Company Overview

Born from a vision to help pet owners avoid economic euthanasia when faced with expensive veterinary bills, Trupanion (NASDAQ:TRUP) provides medical insurance for cats and dogs through data-driven, vertically-integrated products priced specifically for each pet's unique characteristics.

Revenue Growth

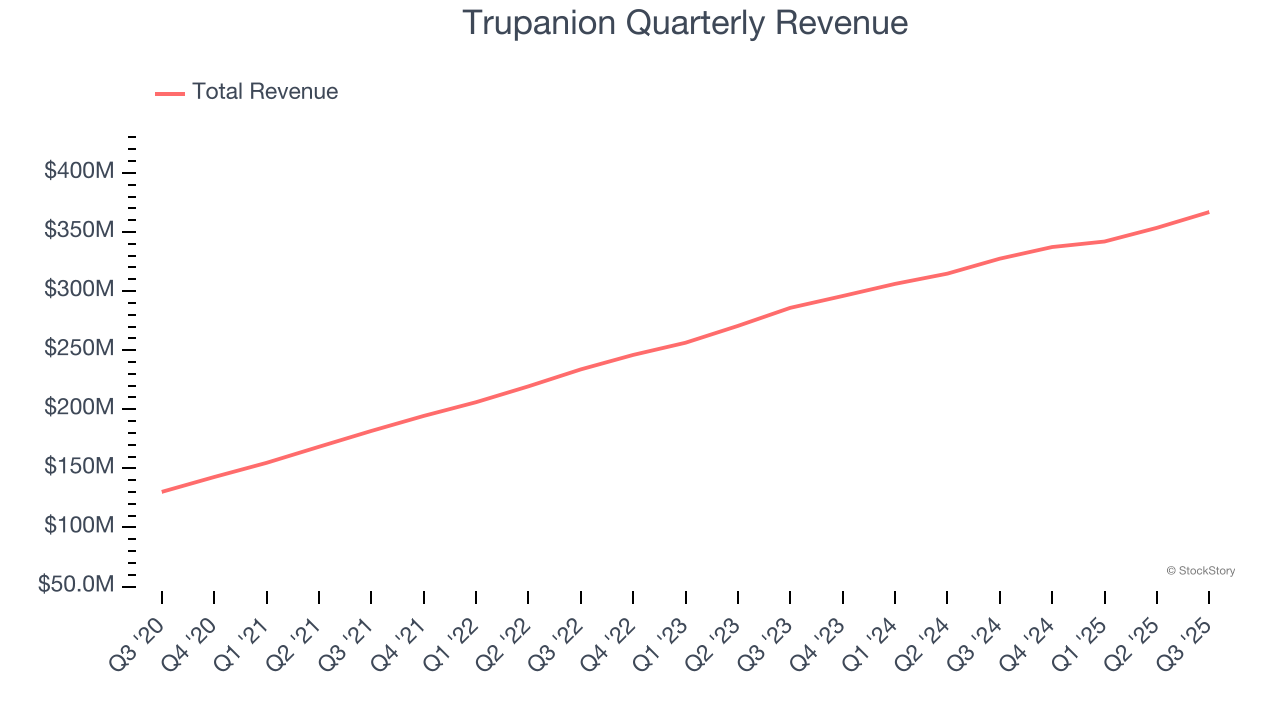

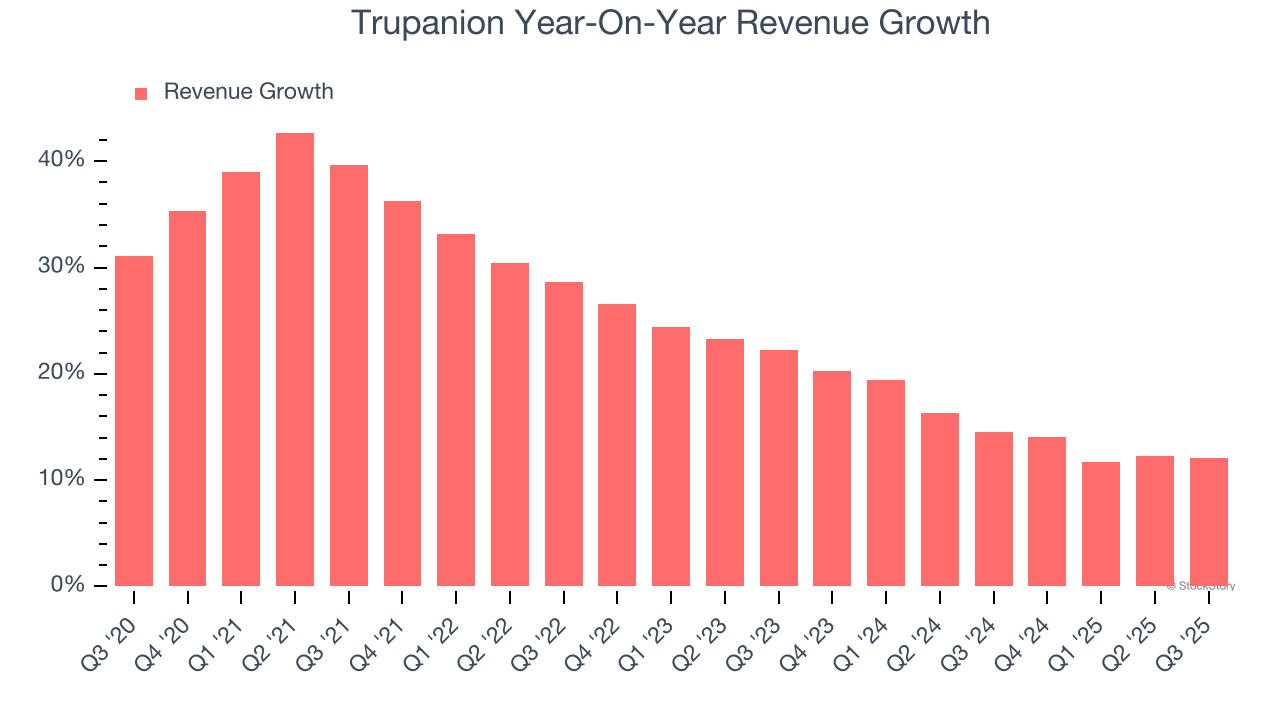

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Luckily, Trupanion’s revenue grew at an incredible 24.7% compounded annual growth rate over the last five years. Its growth beat the average insurance company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Trupanion’s annualized revenue growth of 15% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Trupanion reported year-on-year revenue growth of 12.1%, and its $366.9 million of revenue exceeded Wall Street’s estimates by 1.3%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Trupanion’s Q3 Results

It was good to see Trupanion beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 3.2% to $40.82 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.