Over the past six months, Owens Corning’s shares (currently trading at $139.79) have posted a disappointing 12.6% loss, well below the S&P 500’s 1.5% gain. This may have investors wondering how to approach the situation.

Is now the time to buy Owens Corning, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're cautious about Owens Corning. Here are three reasons why you should be careful with OC and a stock we'd rather own.

Why Is Owens Corning Not Exciting?

Credited with the discovery of fiberglass, Owens Corning (NYSE:OC) supplies building and construction materials to the United States and international markets.

1. Core Business Falling Behind as Demand Declines

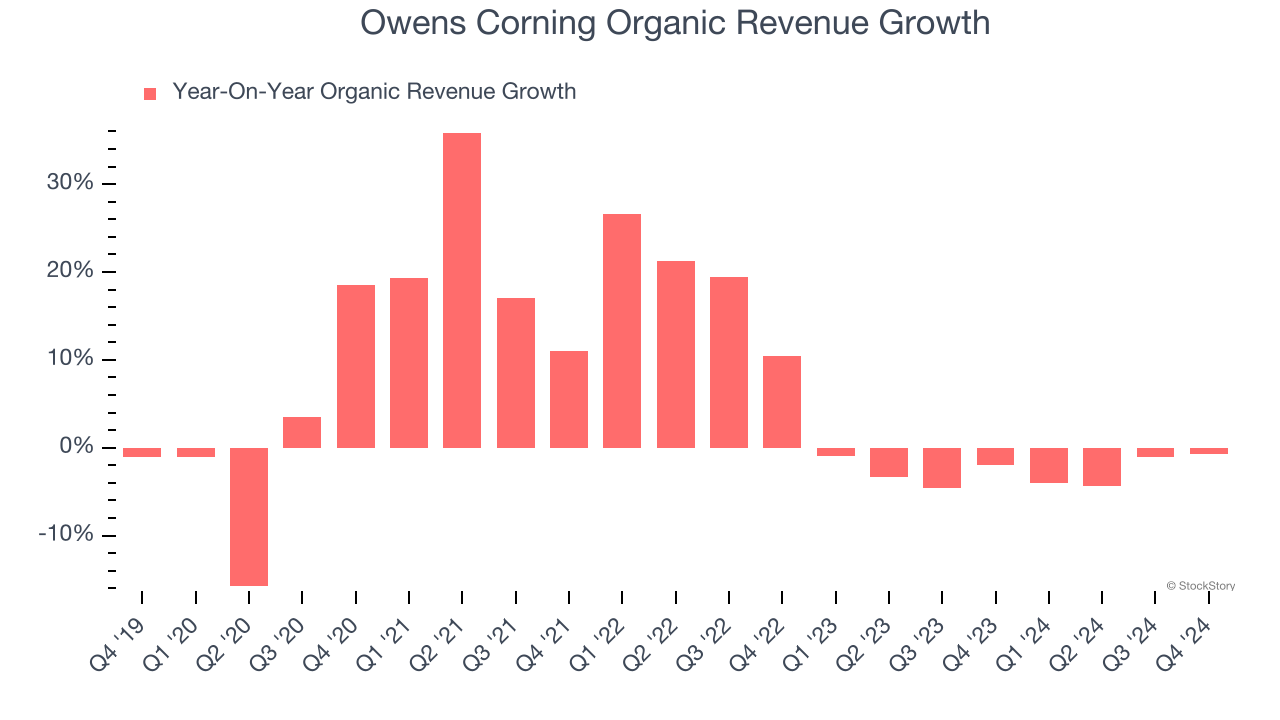

We can better understand Home Construction Materials companies by analyzing their organic revenue. This metric gives visibility into Owens Corning’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Owens Corning’s organic revenue averaged 2.6% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Owens Corning might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Owens Corning’s revenue to drop by 3.2%, a decrease from its 6% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

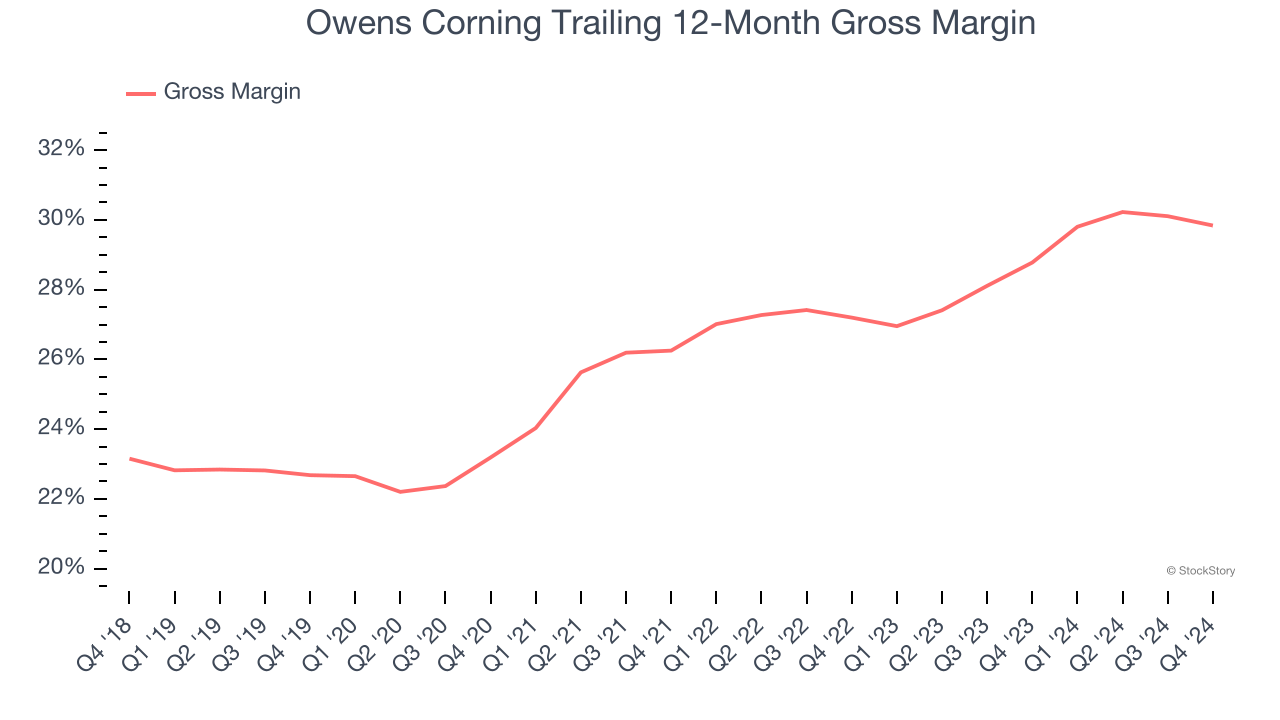

3. Low Gross Margin Hinders Flexibility

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Owens Corning’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 27.4% gross margin over the last five years. That means Owens Corning paid its suppliers a lot of money ($72.63 for every $100 in revenue) to run its business.

Final Judgment

Owens Corning isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 8.6× forward price-to-earnings (or $139.79 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Owens Corning

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.