Medical technology company Intuitive Surgical (NASDAQ:ISRG) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 21.4% year on year to $2.44 billion. Its non-GAAP profit of $2.19 per share was 14.3% above analysts’ consensus estimates.

Is now the time to buy Intuitive Surgical? Find out by accessing our full research report, it’s free.

Intuitive Surgical (ISRG) Q2 CY2025 Highlights:

- Revenue: $2.44 billion vs analyst estimates of $2.35 billion (21.4% year-on-year growth, 3.7% beat)

- Adjusted EPS: $2.19 vs analyst estimates of $1.92 (14.3% beat)

- Slightly raised full-year guidance for Worldwide da Vinci procedure growth and gross margin, maintained full-year operating expense growth guidance

- Operating Margin: 30.5%, up from 28.2% in the same quarter last year

- Market Capitalization: $185 billion

“We’re pleased with our solid performance this quarter, highlighted by continued customer adoption of our newer and existing platforms, including da Vinci 5,” stated Dave Rosa, Intuitive CEO. “We are committed to advancing care, and helping our customers provide better patient outcomes, better patient and care team experiences, broadening access to care and decreasing the total cost of care.”

Company Overview

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ:ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

Revenue Growth

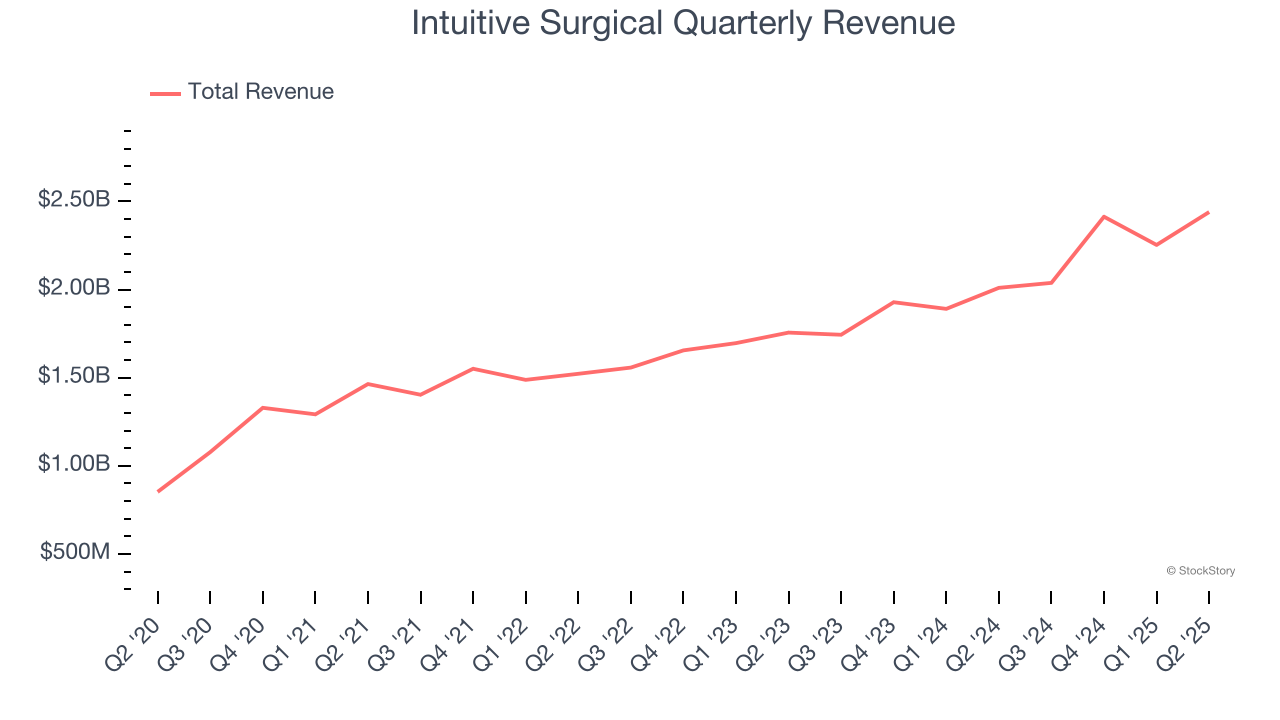

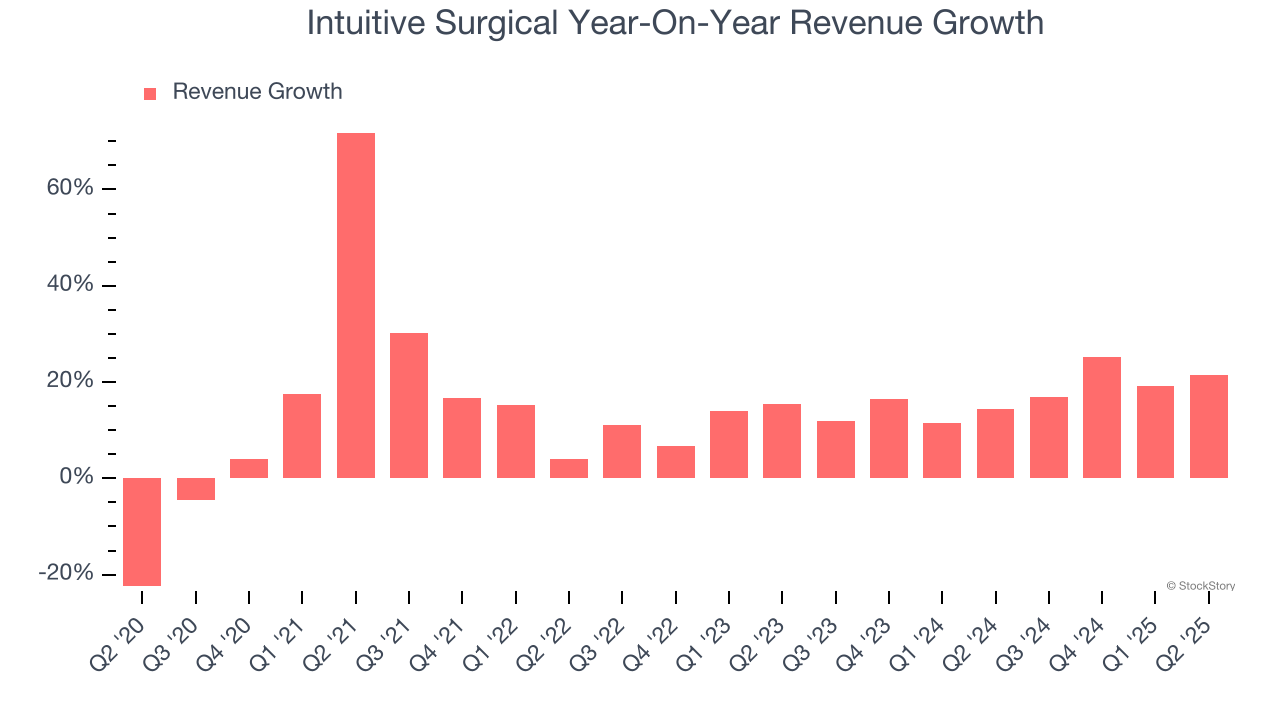

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Intuitive Surgical grew its sales at a solid 16% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Intuitive Surgical’s annualized revenue growth of 17.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Intuitive Surgical reported robust year-on-year revenue growth of 21.4%, and its $2.44 billion of revenue topped Wall Street estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

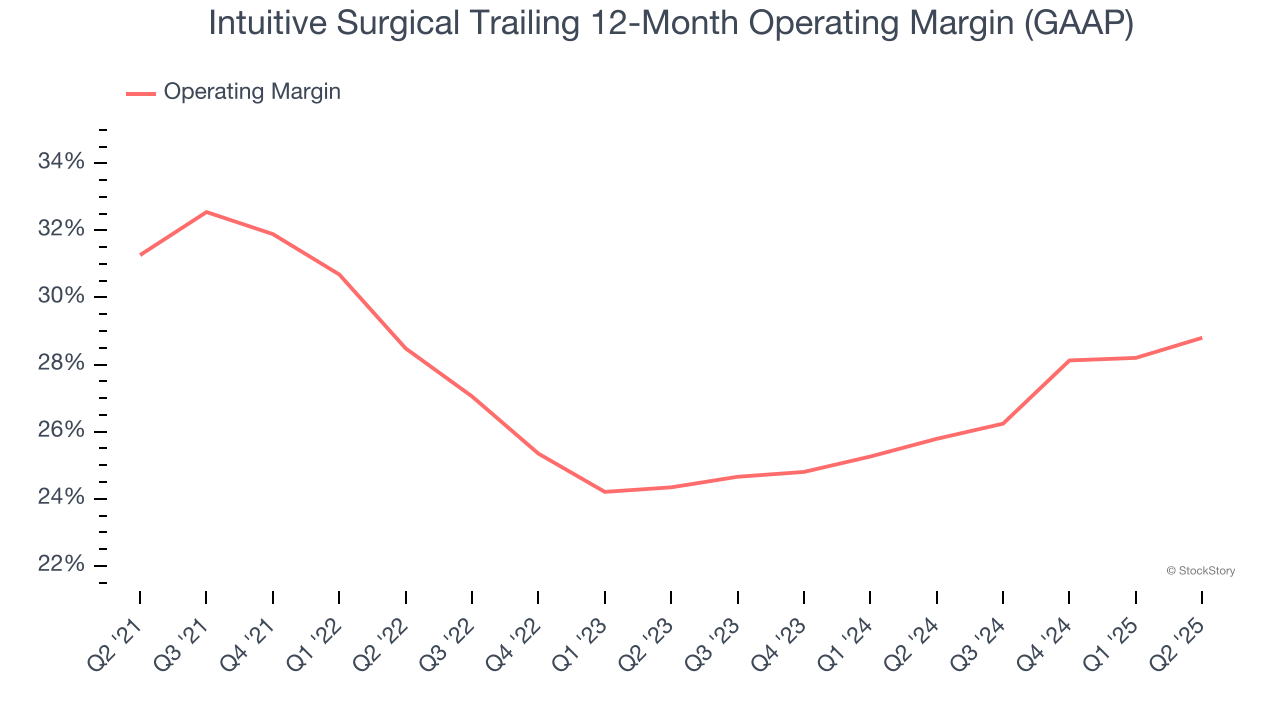

Intuitive Surgical has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 27.6%.

Looking at the trend in its profitability, Intuitive Surgical’s operating margin decreased by 2.5 percentage points over the last five years, but it rose by 4.5 percentage points on a two-year basis. We like Intuitive Surgical and hope it can right the ship.

This quarter, Intuitive Surgical generated an operating margin profit margin of 30.5%, up 2.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

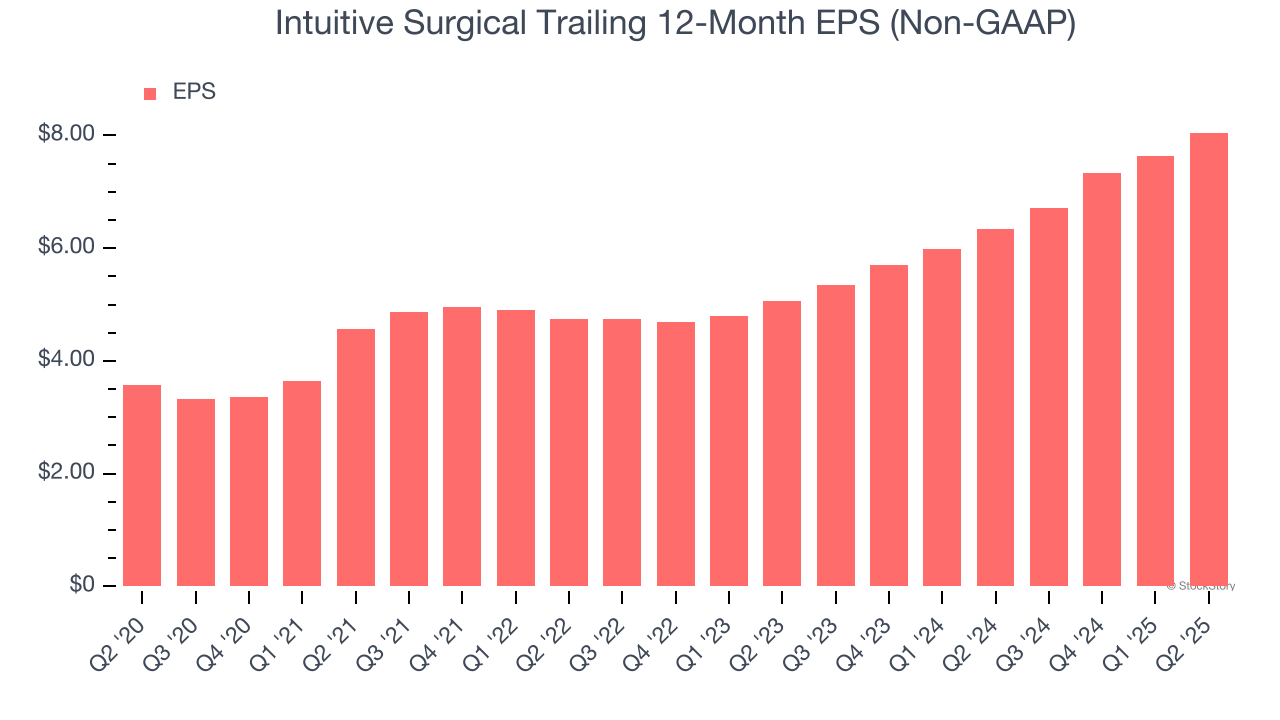

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Intuitive Surgical’s astounding 17.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q2, Intuitive Surgical reported EPS at $2.19, up from $1.78 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Intuitive Surgical’s full-year EPS of $8.05 to grow 3.5%.

Key Takeaways from Intuitive Surgical’s Q2 Results

We enjoyed seeing Intuitive Surgical beat analysts’ revenue and EPS expectations this quarter. We were also glad that the company slightly raised full-year outlook for Worldwide da Vinci procedure growth and gross margin. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and shares traded down 3.6% to $492.99 immediately following the results.

So should you invest in Intuitive Surgical right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.