Industrial and safety product distributor Distribution Solutions (NASDAQ:DSGR) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.3% year on year to $502.4 million. Its non-GAAP profit of $0.35 per share was 5% above analysts’ consensus estimates.

Is now the time to buy Distribution Solutions? Find out by accessing our full research report, it’s free.

Distribution Solutions (DSGR) Q2 CY2025 Highlights:

- Revenue: $502.4 million vs analyst estimates of $484.4 million (14.3% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.33 (5% beat)

- Adjusted EBITDA: $48.56 million vs analyst estimates of $45.3 million (9.7% margin, 7.2% beat)

- Operating Margin: 5.3%, in line with the same quarter last year

- Free Cash Flow Margin: 4.8%, up from 3.6% in the same quarter last year

- Market Capitalization: $1.34 billion

Company Overview

Founded in 1952, Distribution Solutions (NASDAQ:DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Revenue Growth

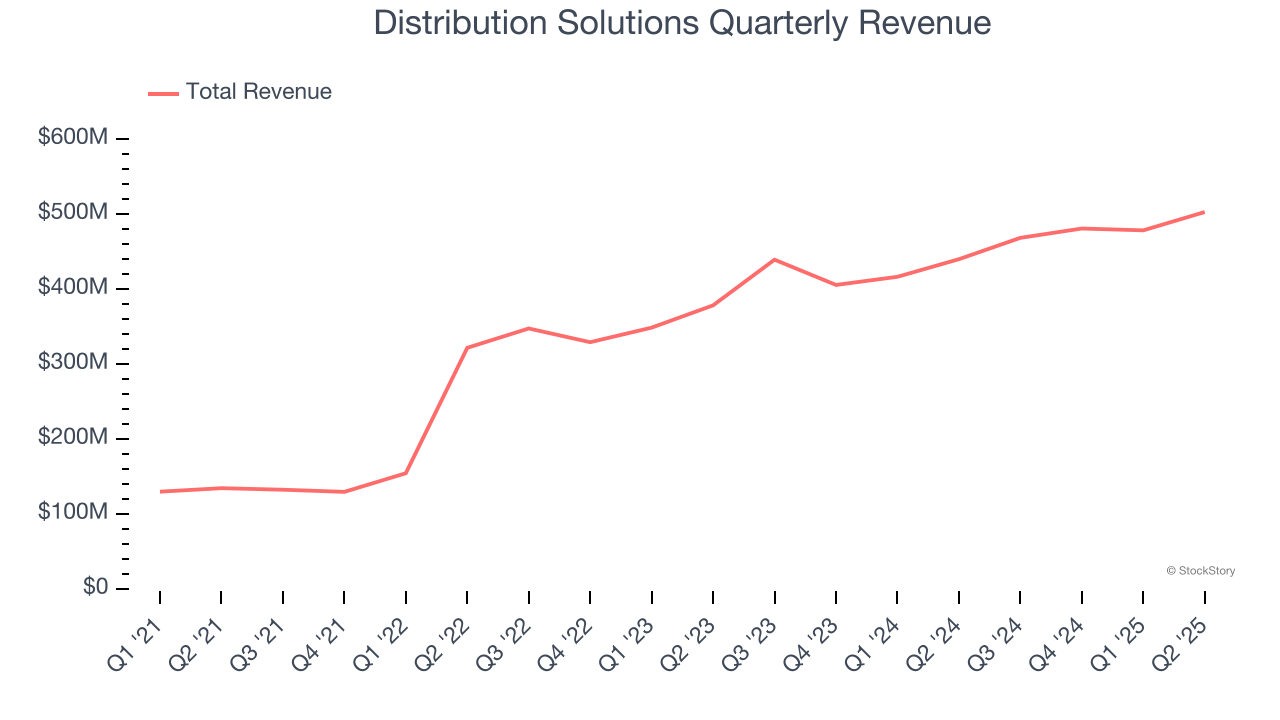

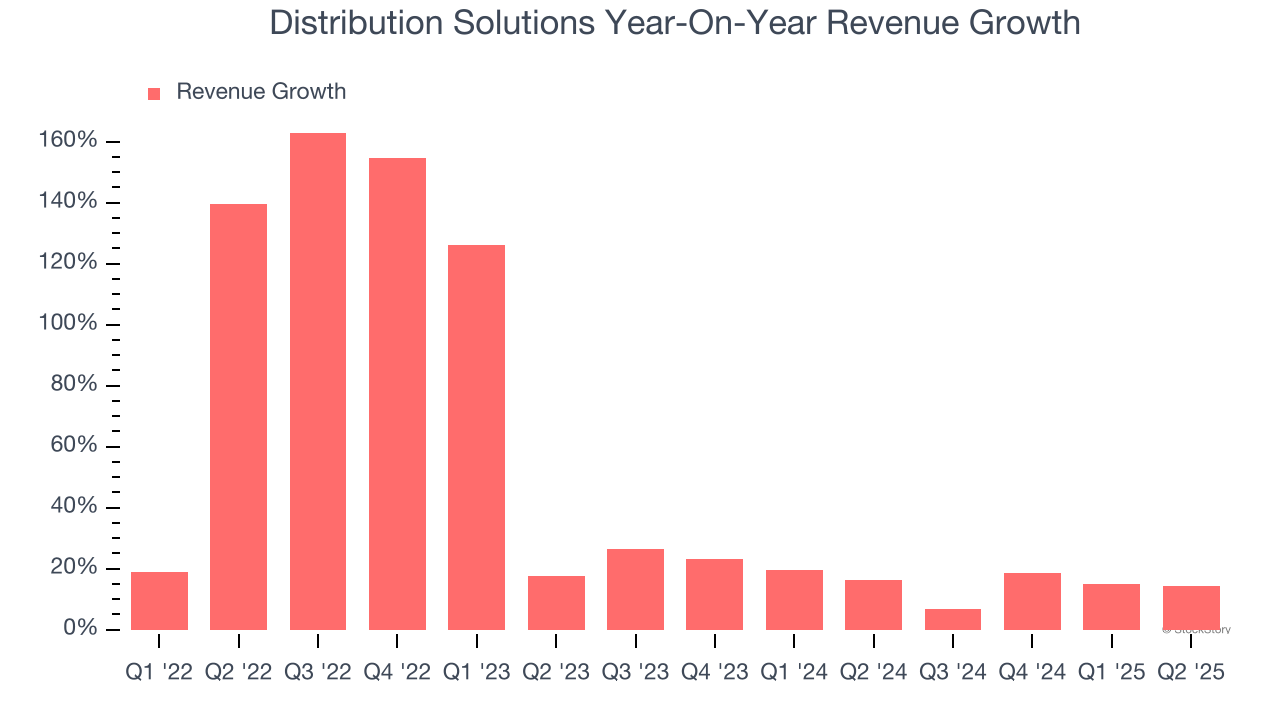

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Distribution Solutions’s 38.9% annualized revenue growth over the last four years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Distribution Solutions’s annualized revenue growth of 17.3% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Distribution Solutions reported year-on-year revenue growth of 14.3%, and its $502.4 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

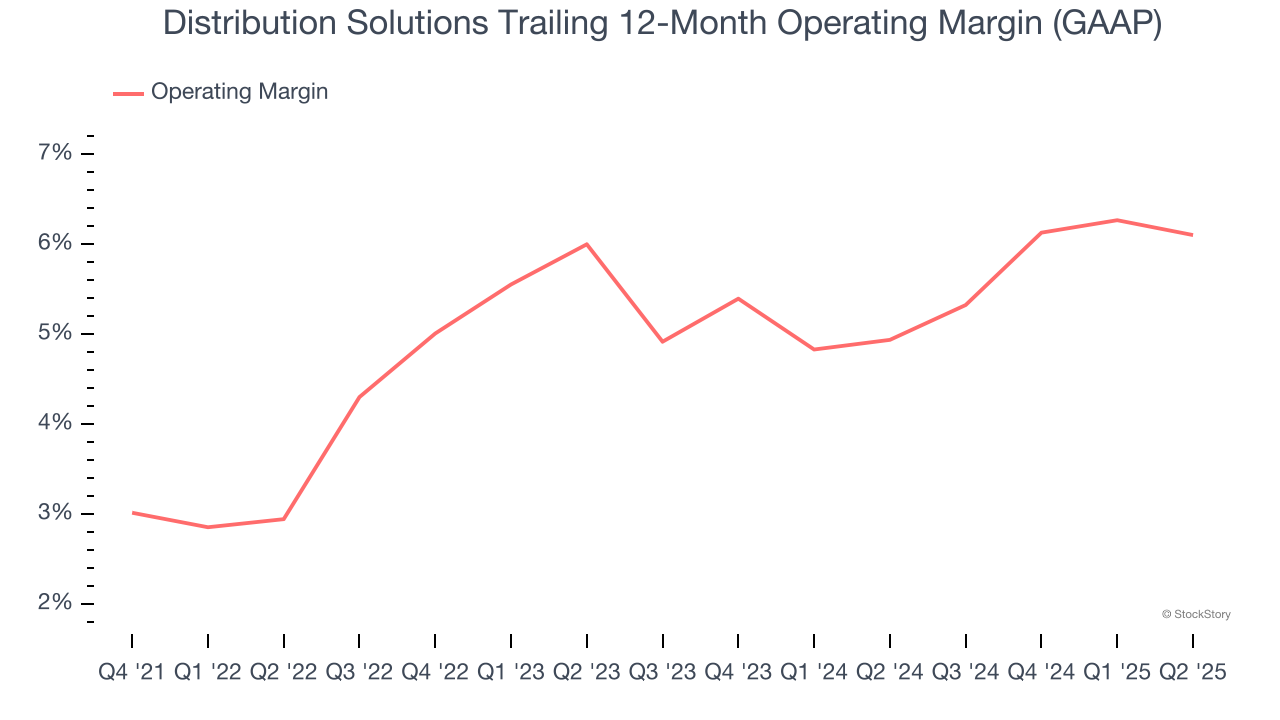

Operating Margin

Distribution Solutions was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

On the plus side, Distribution Solutions’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Distribution Solutions generated an operating margin profit margin of 5.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Cash Is King

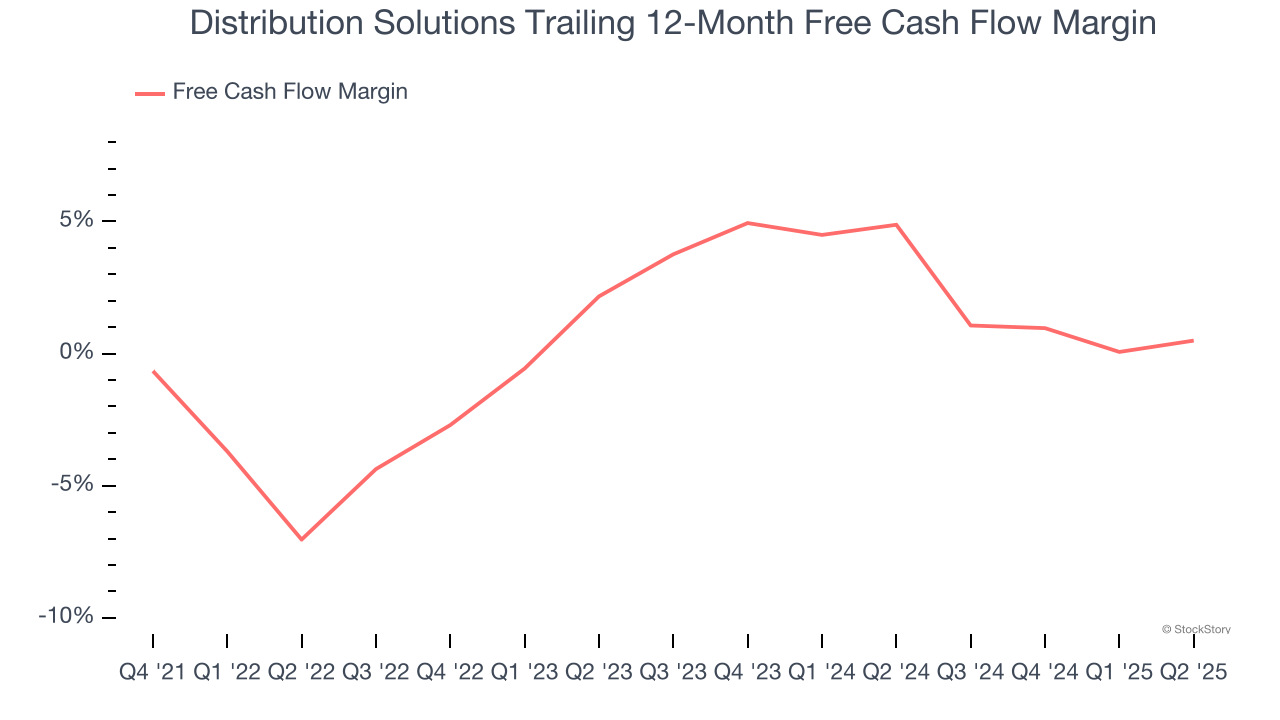

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Distribution Solutions has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.2%, lousy for an industrials business.

Distribution Solutions’s free cash flow clocked in at $24.34 million in Q2, equivalent to a 4.8% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

Key Takeaways from Distribution Solutions’s Q2 Results

We were impressed by how significantly Distribution Solutions blew past analysts’ revenue expectations this quarter. We were also glad its EPS and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $28.79 immediately after reporting.

So do we think Distribution Solutions is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.