What a brutal six months it’s been for Samsara. The stock has dropped 26.3% and now trades at $37.90, rattling many shareholders. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy IOT? Find out in our full research report, it’s free.

Why Is IOT a Good Business?

One of the few public companies where famed investor Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

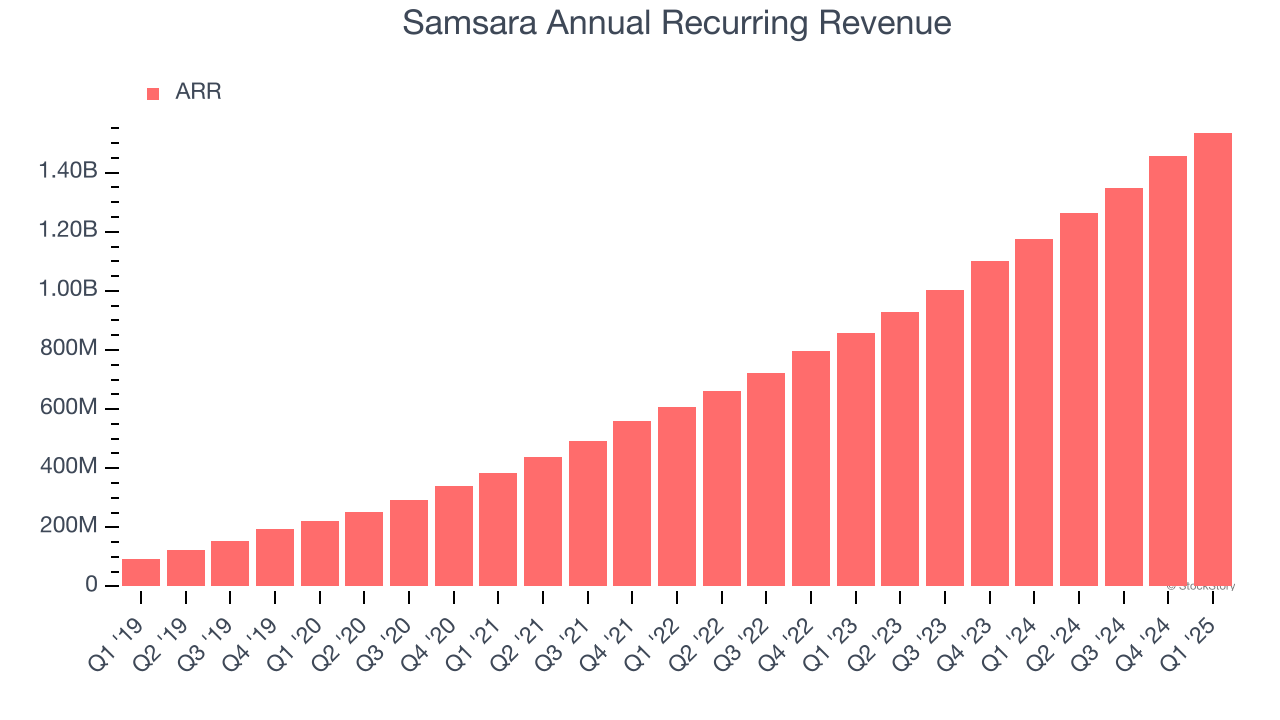

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.54 billion in Q1, and over the last four quarters, its year-on-year growth averaged 33.3%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Samsara a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Samsara’s revenue to rise by 22.1%. While this projection is below its 40.3% annualized growth rate for the past three years, it is noteworthy and suggests the market sees success for its products and services.

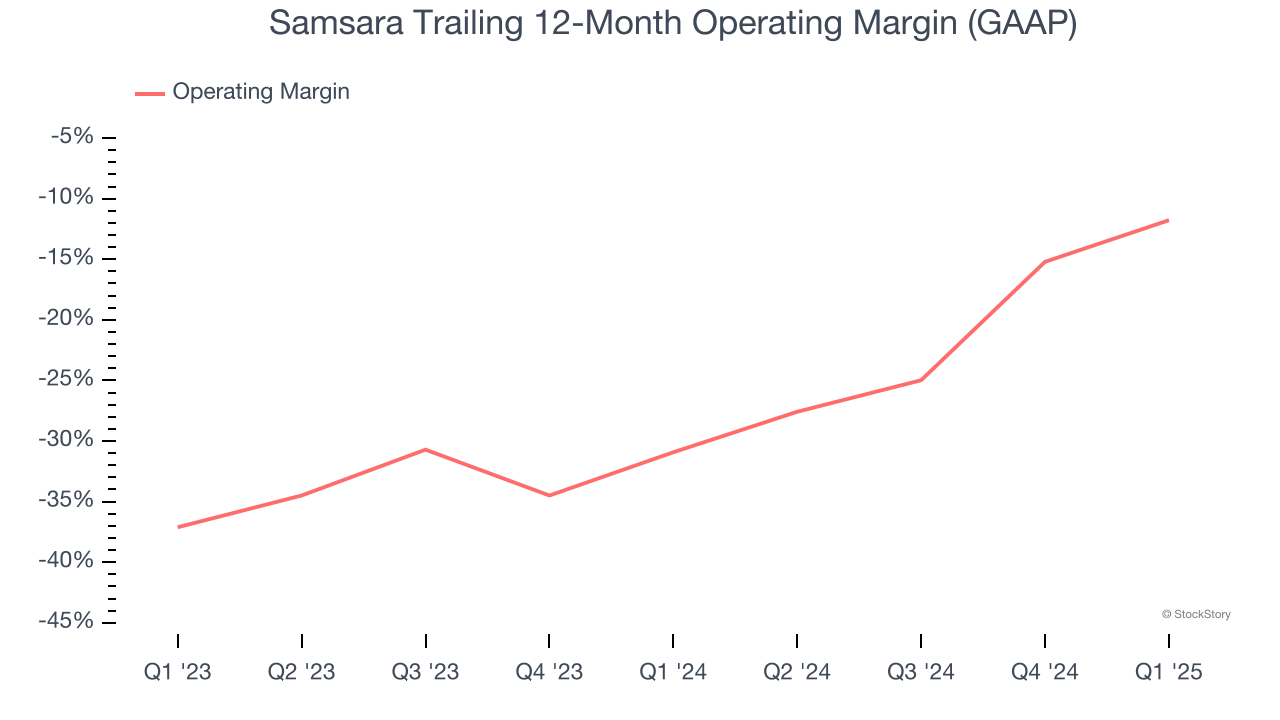

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Over the last year, Samsara’s expanding sales gave it operating leverage as its margin rose by 19.2 percentage points. Although its operating margin for the trailing 12 months was negative 11.8%, we’re confident it can one day reach sustainable profitability.

Final Judgment

These are just a few reasons why we think Samsara is a great business. After the recent drawdown, the stock trades at 13.2× forward price-to-sales (or $37.90 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.