Private prison operator CoreCivic (NYSE:CXW) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 9.8% year on year to $538.2 million. Its non-GAAP profit of $0.36 per share was 73.1% above analysts’ consensus estimates.

Is now the time to buy CoreCivic? Find out by accessing our full research report, it’s free.

CoreCivic (CXW) Q2 CY2025 Highlights:

- Revenue: $538.2 million vs analyst estimates of $495.6 million (9.8% year-on-year growth, 8.6% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.21 (73.1% beat)

- Adjusted EBITDA: $103.3 million vs analyst estimates of $82.22 million (19.2% margin, 25.7% beat)

- Adjusted EPS guidance for the full year is $1.11 at the midpoint, beating analyst estimates by 17.6%

- EBITDA guidance for the full year is $368 million at the midpoint, above analyst estimates of $342.7 million

- Market Capitalization: $2.14 billion

Company Overview

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE:CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2 billion in revenue over the past 12 months, CoreCivic is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

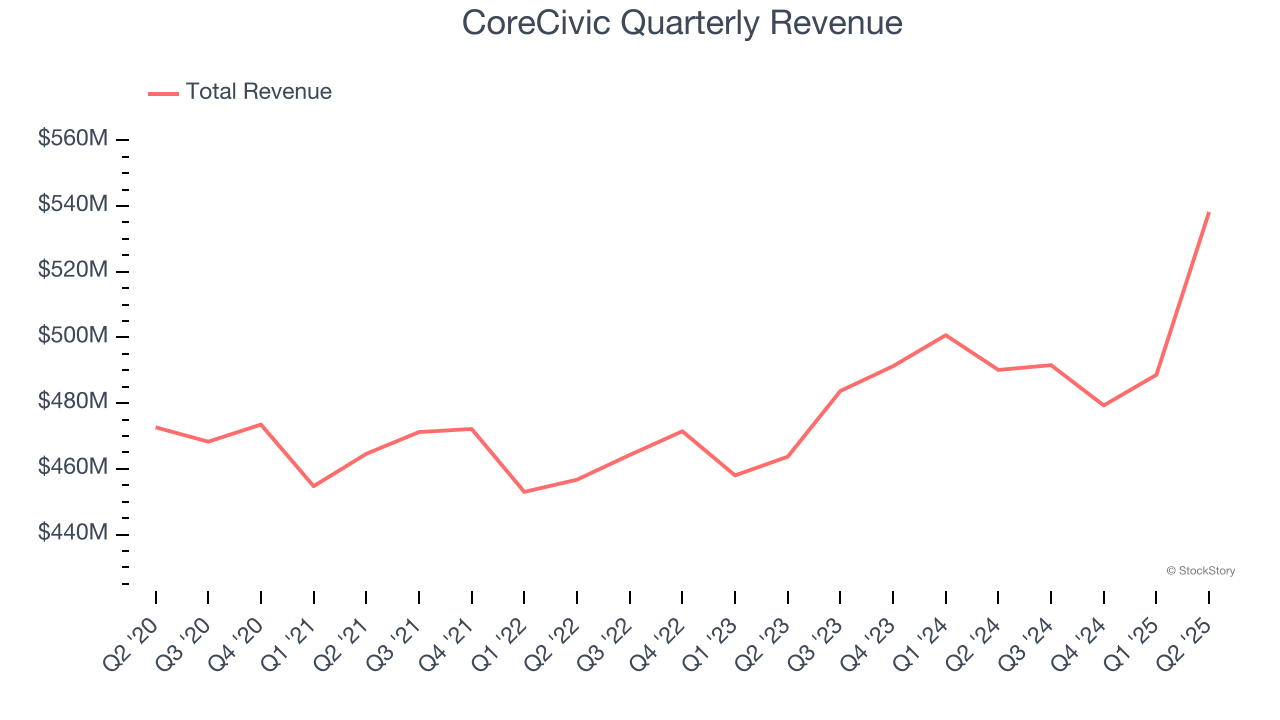

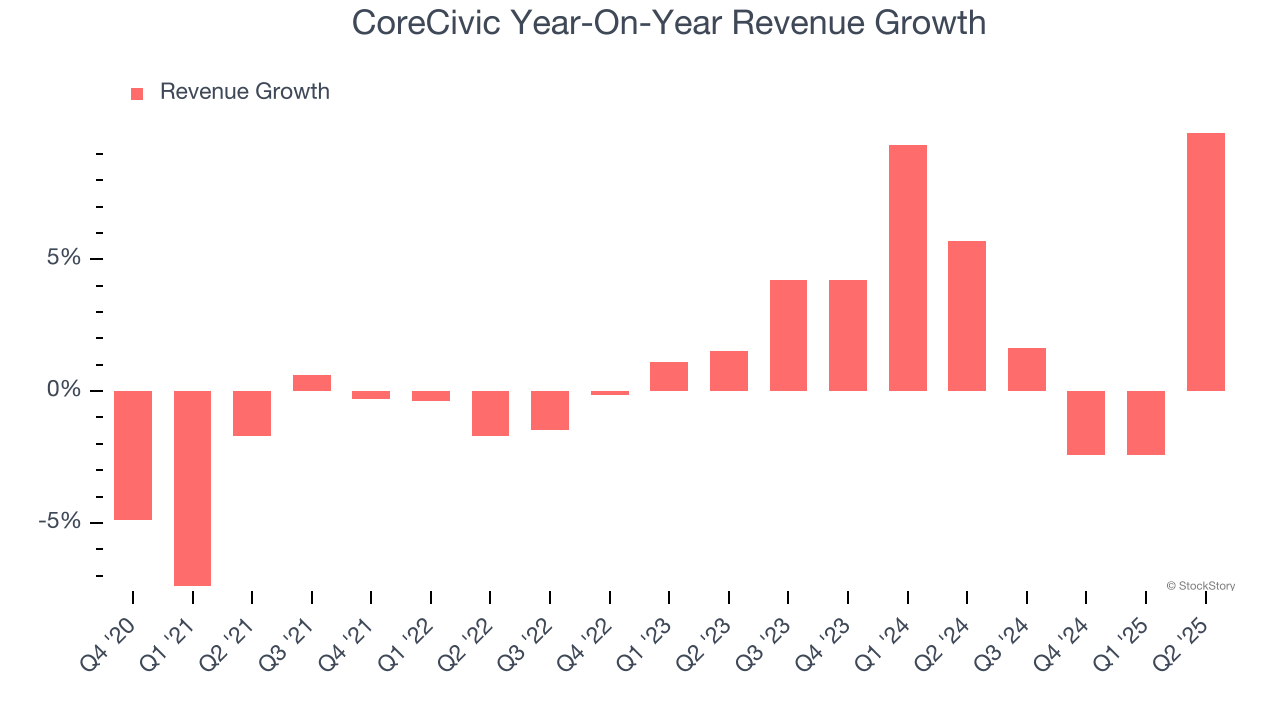

As you can see below, CoreCivic struggled to increase demand as its $2 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. CoreCivic’s annualized revenue growth of 3.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, CoreCivic reported year-on-year revenue growth of 9.8%, and its $538.2 million of revenue exceeded Wall Street’s estimates by 8.6%.

Looking ahead, sell-side analysts expect revenue to grow 11.7% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

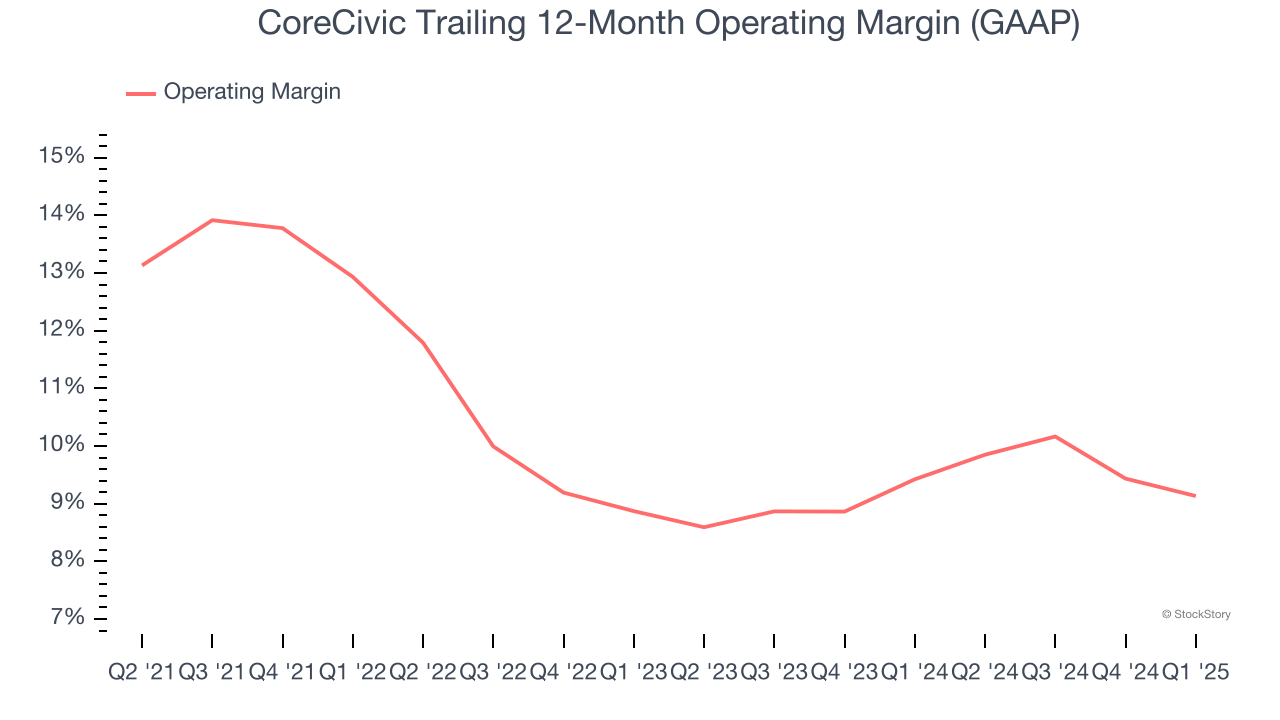

CoreCivic has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.5%, higher than the broader business services sector.

Analyzing the trend in its profitability, CoreCivic’s operating margin decreased by 4 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see CoreCivic become more profitable in the future.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

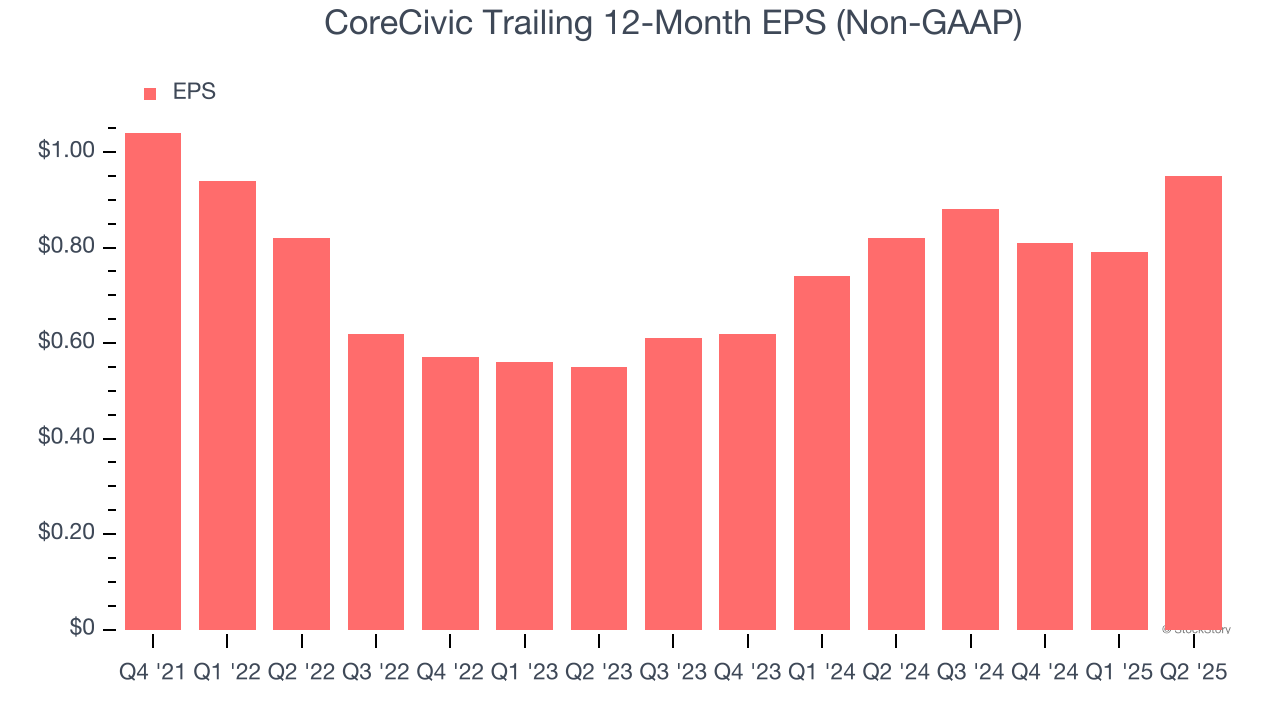

CoreCivic’s full-year EPS grew at an unimpressive 4.8% compounded annual growth rate over the last four years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

CoreCivic’s EPS grew at an astounding 31.4% compounded annual growth rate over the last two years, higher than its 3.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

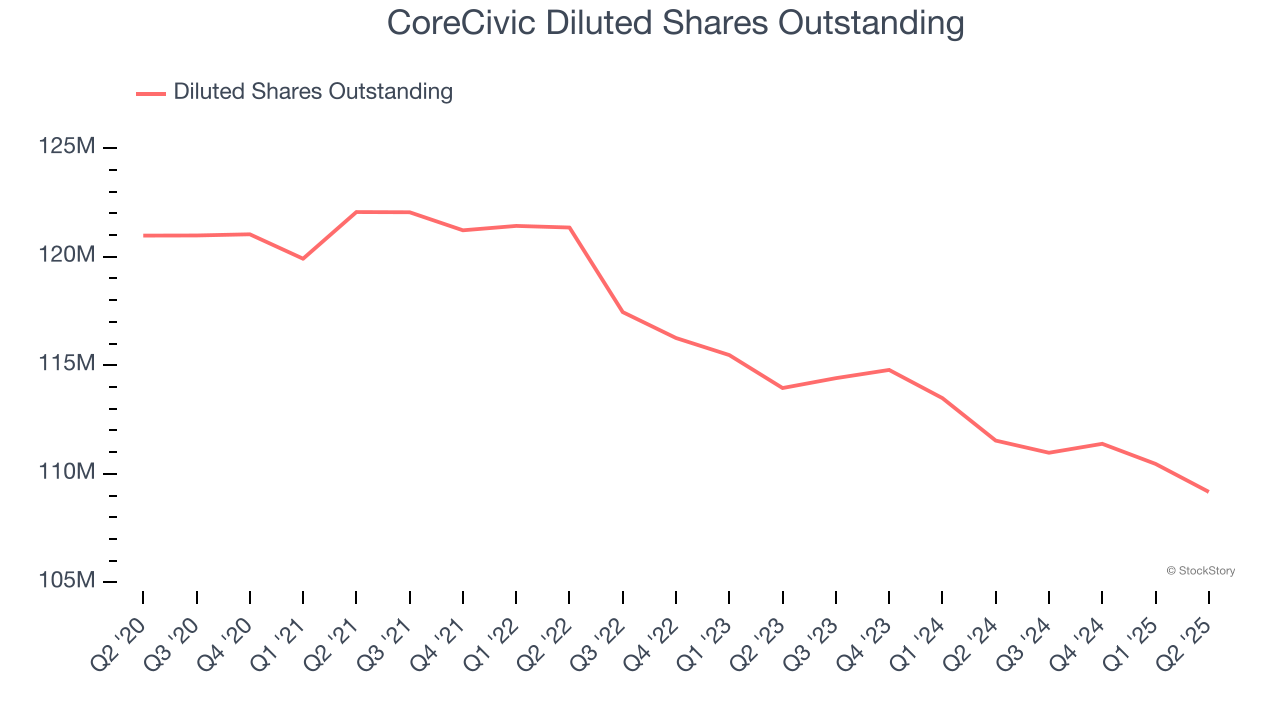

Diving into the nuances of CoreCivic’s earnings can give us a better understanding of its performance. A two-year view shows that CoreCivic has repurchased its stock, shrinking its share count by 4.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q2, CoreCivic reported adjusted EPS at $0.36, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CoreCivic’s full-year EPS of $0.95 to grow 30.1%.

Key Takeaways from CoreCivic’s Q2 Results

We were impressed by how significantly CoreCivic blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $19.60 immediately following the results.

Big picture, is CoreCivic a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.