Exercise equipment company Peloton (NASDAQ:PTON) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 5.7% year on year to $606.9 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $535 million was less impressive, coming in 3.3% below expectations. Its GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Peloton? Find out by accessing our full research report, it’s free.

Peloton (PTON) Q2 CY2025 Highlights:

- Revenue: $606.9 million vs analyst estimates of $580.3 million (5.7% year-on-year decline, 4.6% beat)

- EPS (GAAP): $0.05 vs analyst estimates of -$0.05 (significant beat)

- Adjusted EBITDA: $140 million vs analyst estimates of $83.17 million (23.1% margin, 68.3% beat)

- Revenue Guidance for Q3 CY2025 is $535 million at the midpoint, below analyst estimates of $553 million

- EBITDA guidance for the upcoming financial year 2026 is $425 million at the midpoint, above analyst estimates of $355.7 million

- Operating Margin: 4.9%, up from -9.9% in the same quarter last year

- Free Cash Flow Margin: 18.5%, up from 4% in the same quarter last year

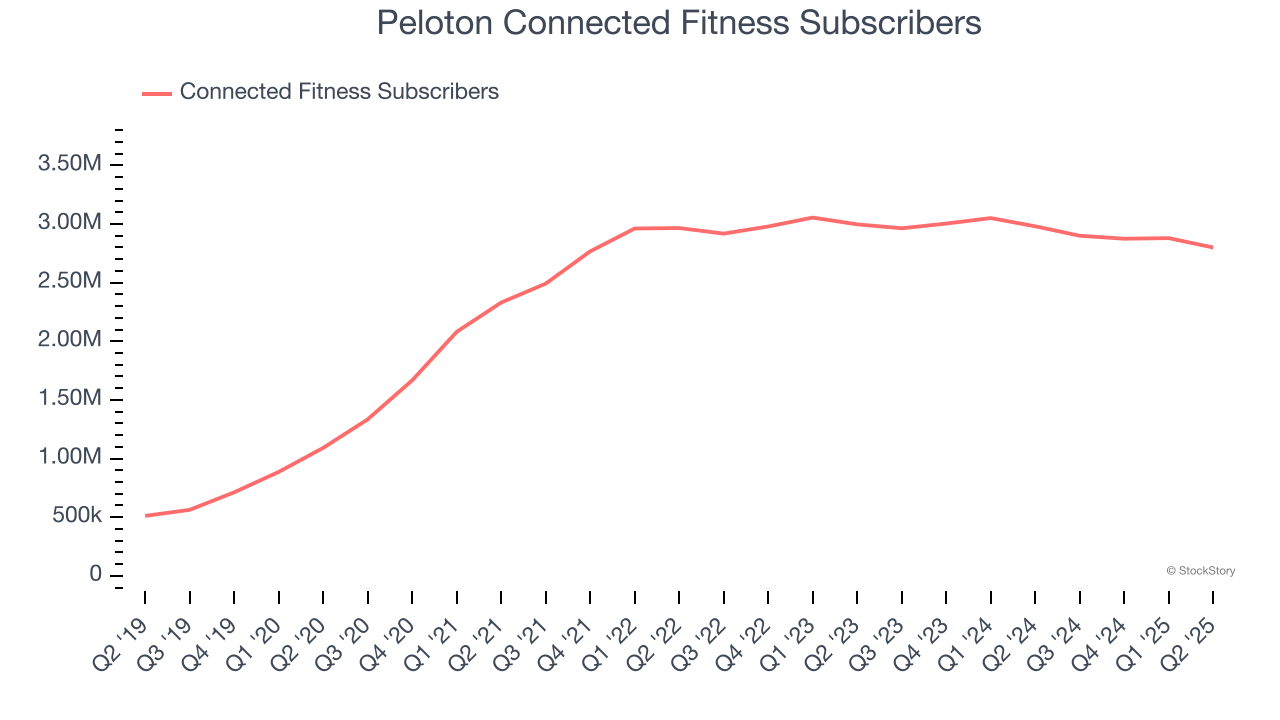

- Connected Fitness Subscribers: 2.8 million, down 181,000 year on year

- Market Capitalization: $2.82 billion

Company Overview

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Revenue Growth

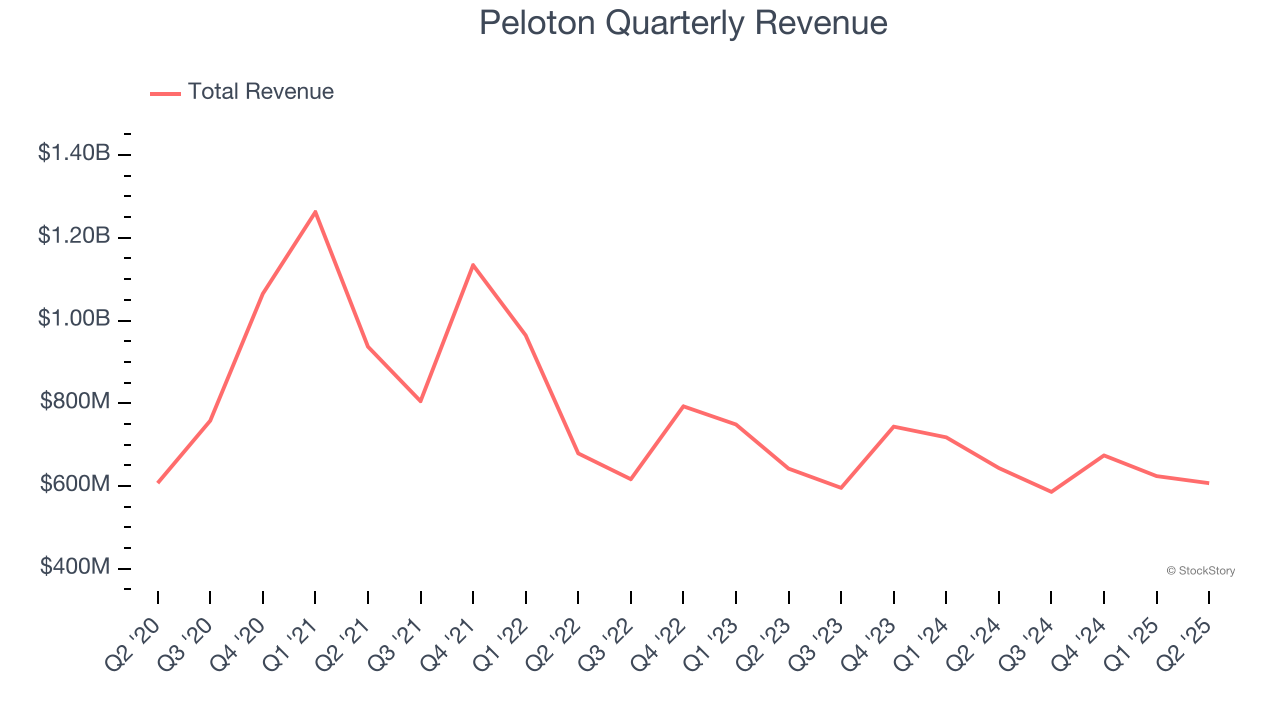

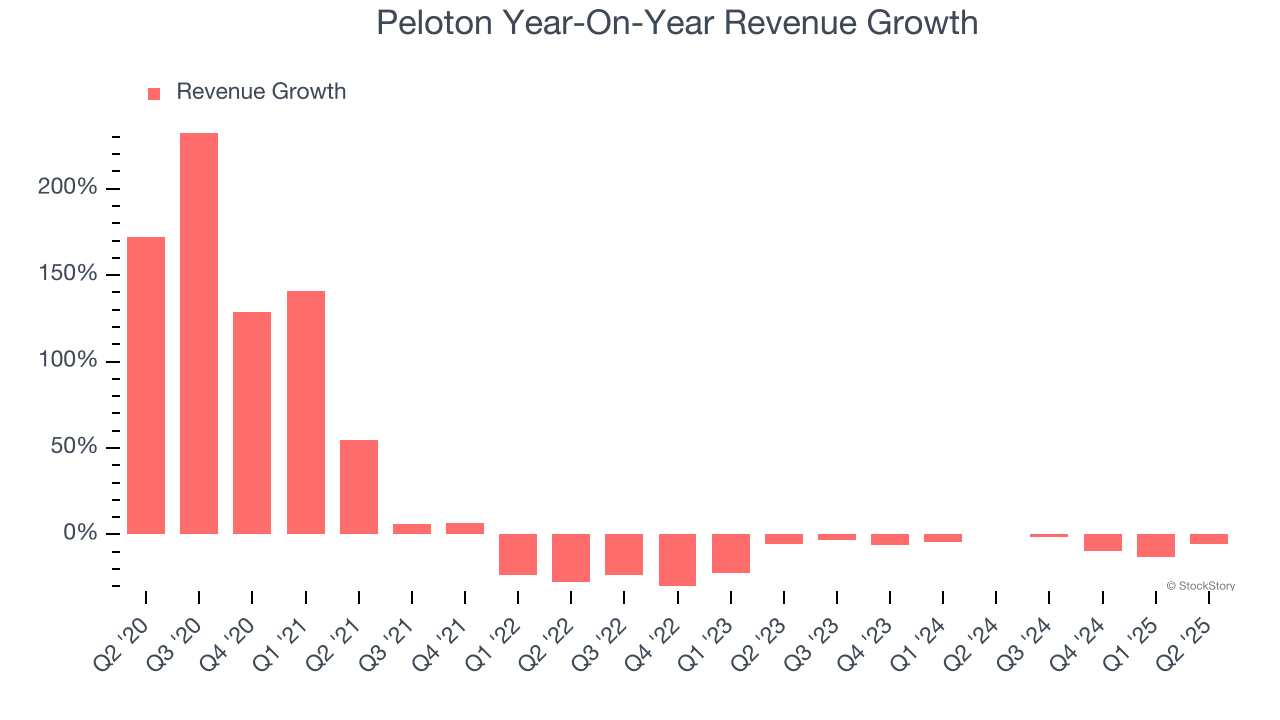

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Peloton grew its sales at a sluggish 6.4% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Peloton’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.7% annually.

Peloton also discloses its number of connected fitness subscribers, which reached 2.8 million in the latest quarter. Over the last two years, Peloton’s connected fitness subscribers averaged 2.1% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Peloton’s revenue fell by 5.7% year on year to $606.9 million but beat Wall Street’s estimates by 4.6%. Company management is currently guiding for a 8.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3.6% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

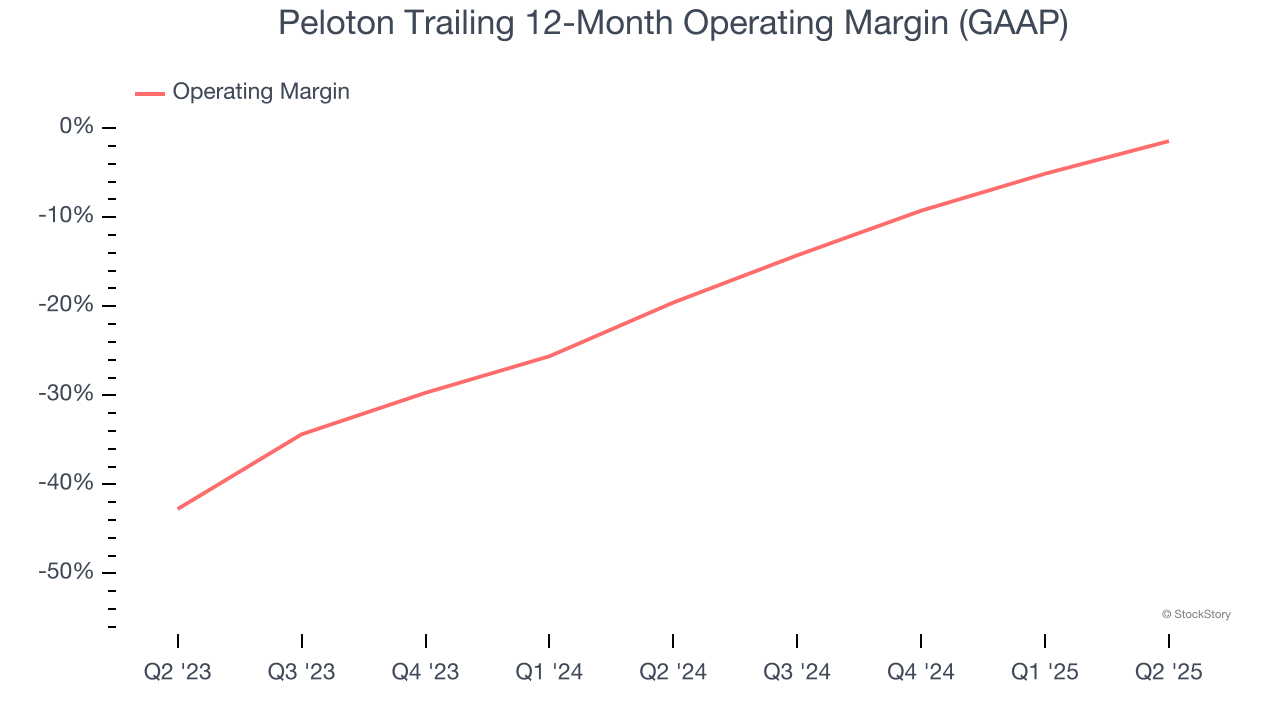

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Peloton’s operating margin has risen over the last 12 months, but it still averaged negative 10.9% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Peloton generated an operating margin profit margin of 4.9%, up 14.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

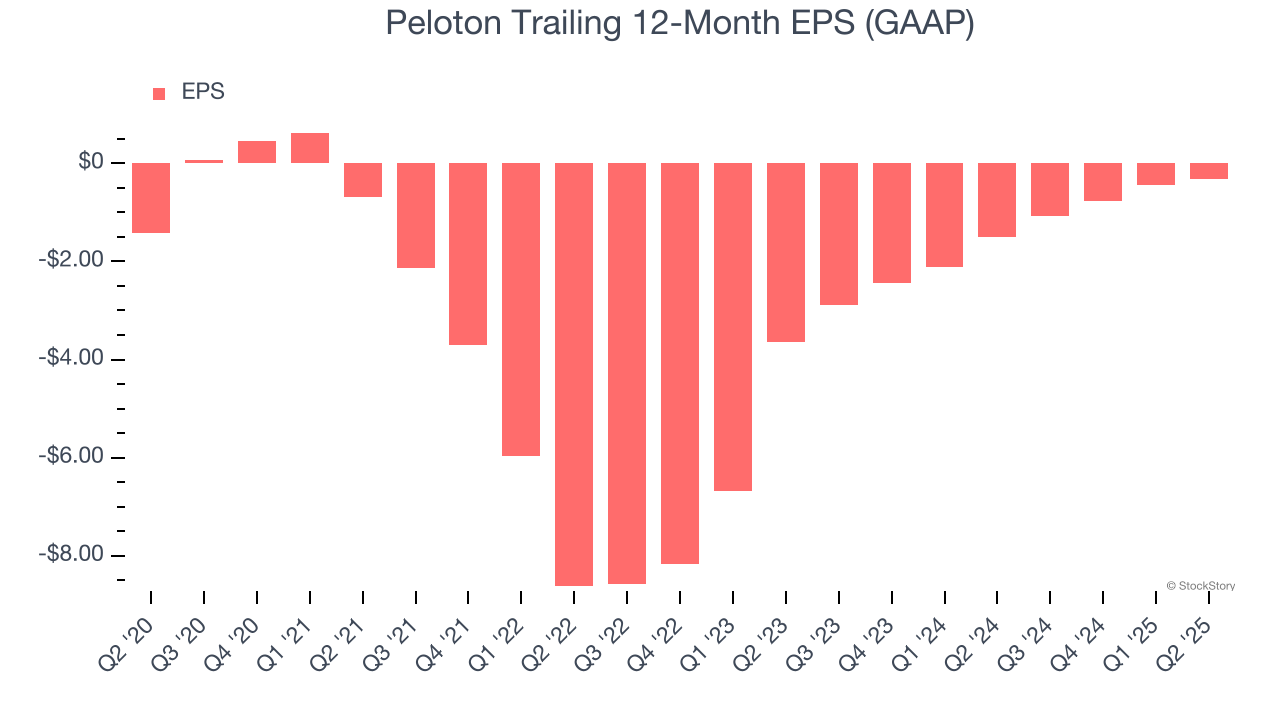

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Peloton’s full-year earnings are still negative, it reduced its losses and improved its EPS by 26% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, Peloton reported EPS at $0.05, up from negative $0.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Peloton’s full-year EPS of negative $0.31 will reach break even.

Key Takeaways from Peloton’s Q2 Results

We were impressed by how significantly Peloton blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock remained flat at $7.13 immediately after reporting.

Peloton put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.