Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

EUR/USD rebounds as risk-on sentiment weakens Dollar after brief two-day DXY rally.

Via Talk Markets · February 6, 2026

Margin debt as a percentage of market cap of the stock market has gone from 1.6% to 2.3% $1.23 trillion over the last three years.

Via Talk Markets · February 6, 2026

The Dow Jones Industrial Average is one of the preeminent U.S. equity barometers, with close to 130 years of live history.

Via Talk Markets · February 6, 2026

The S&P 500 just closed the week unchanged to the penny. Meanwhile the Nasdaq barely caught the lower edge of its expected move.

Via Talk Markets · February 6, 2026

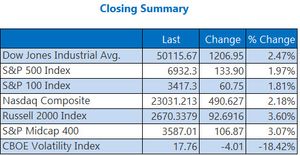

The Dow snapped its three-week losing streak on Friday, tacking on more than 1,200 points to secure its best day since May and close at a new record high.

Via Talk Markets · February 6, 2026

Gold just soared to some of its most-overbought levels on record, climaxing its largest cyclical bull ever. That was followed by one of gold’s worst down days in history, formally slaying that monster bull.

Via Talk Markets · February 6, 2026

We should expect rising layoffs going into 2026.

Via Talk Markets · February 6, 2026

Via Talk Markets · February 6, 2026

The AI story, at least as it pertains to Big Tech hyper-scalers, is imploding in real-time.

Via Talk Markets · February 6, 2026

ConocoPhillips reported strong cash flow yesterday and said it would pay shareholders 45% of its operating cash flow. That makes COP stock look cheap.

Via Talk Markets · February 6, 2026

Rising rates, crowded software trades, and new AI competitors are compressing margins and breaking long-term trends across software and private credit.

Via Talk Markets · February 6, 2026

An analysis and commentary on the financial markets.

Via Talk Markets · February 6, 2026

Recent trading patterns suggest a clear shift in where and how metals prices are being set.

Via Talk Markets · February 6, 2026

Gold and silver are volatile, confidence in currencies is being tested, and next week British money itself goes on trial.

Via Talk Markets · February 6, 2026

First Capital Real Estate Investment Trust is a monthly dividend stock with a high yield. This potentially makes the stock more attractive for income investors looking for more frequent dividend payouts.

Via Talk Markets · February 6, 2026

Rithm Capital Corp. provides real estate, credit, and financial services.

Via Talk Markets · February 6, 2026

Gold looks for the next fundamental signal as price action continues its volatile road.

Via Talk Markets · February 6, 2026

Surging volatility across assets has a margin-call feel, highlighting the need for tight risk control and live market guidance.

Via Talk Markets · February 6, 2026

Actual hires rose 172,000 to 5.293 million, in line with the monthly average over the previous six months. Quits also rose 11,000 to 3.2.04 million, also solidly in their 18 month recent range.

Via Talk Markets · February 6, 2026

The rebound lifted the Dow to one of its strongest single-day advances this year and pushed major indexes back toward weekly equilibrium.

Via Talk Markets · February 6, 2026

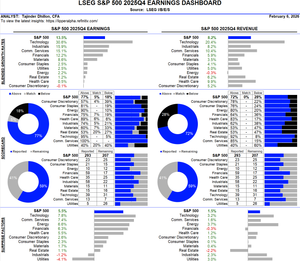

25Q4Y/Y earnings are expected to be 13.5%. Excluding the energy sector, the Y/Y earnings estimate is 14.0%

Via Talk Markets · February 6, 2026

Gold rebounds from $4,655 daily lows as weaker US labor data pressures the Greenback.

Via Talk Markets · February 6, 2026

When selecting a high yield dividend strategy, headline yield matters—but so does the strength of the companies delivering it.

Via Talk Markets · February 6, 2026

The US dollar is seeing this week’s gains pared against most of the G10 currencies today.

Via Talk Markets · February 6, 2026

The market got off to a strong start in 2026, with investors chasing industrials, materials, and commodity-related stocks as the reflation narrative gained traction.

Via Talk Markets · February 6, 2026

A sharp sell-off has shaken the tech sector, hitting software stocks and cryptocurrencies amid weak labour market data and doubts about AI-driven valuations.

Via Talk Markets · February 6, 2026

Stock markets tumbled this week amid growing concerns about artificial intelligence's impact on software companies, weakening labor market data, and uncertainty over tech valuations.

Via Talk Markets · February 6, 2026

QBTS tumbled nearly 15% yesterday, sits 34% below where it started 2026, and trades 63% below its all-time high, reflecting a broad investor retreat.

Via Talk Markets · February 6, 2026

Tether mints $1B USDT, increasing February issuance to $3B, as Bitcoin drops over 10%, sparking liquidity concerns in crypto markets.

Via Talk Markets · February 6, 2026

London's FTSE 100 edged higher on Friday.

Via Talk Markets · February 6, 2026

Johnson & Johnson (JNJ) has a diversified business model that makes it resilient through economic cycles.

JNJ is trading at new all-time highs.

Via Talk Markets · February 6, 2026

EUR/USD remains capped below 1.1800, with 1.1765 low at hand.

Via Talk Markets · February 6, 2026

The Pound has seen gains against the dollar erased as the pair continues to sell off.

Via Talk Markets · February 6, 2026

The EIA projects dry natural gas production to climb 1% in 2026 to around 109 Bcf/d, driven by Permian Basin expansions and new takeaway capacity coming online in the latter half of the year.

Via Talk Markets · February 6, 2026

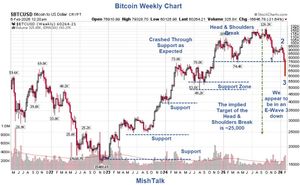

Bitcoin topped in October 2025, ending the three-year bull cycle. The market is now unfolding a higher-degree corrective phase, with wave A in progress and a broader wave IV expected to play out through 2026.

Via Talk Markets · February 6, 2026

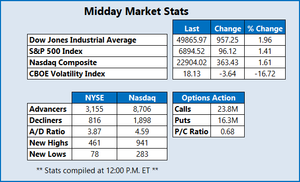

Stocks are confidently higher midday, as investors step back into tech names and put Wall Street on track to close a choppy week on a high note.

Via Talk Markets · February 6, 2026

MSTR, a leveraged Bitcoin proxy, reports $12 billion loss.

Via Talk Markets · February 6, 2026

Cincinnati Financial Corp. is an insurance holding company that primarily markets property and casualty coverage. It also conducts life insurance and asset management operations.

Via Talk Markets · February 6, 2026

Value-oriented investors may find that WLKP’s current pricing reflects headline fear rather than cash-flow reality.

Via Talk Markets · February 6, 2026

China’s inflation data is likely to cool in January.

Via Talk Markets · February 6, 2026

Gold rebounds as weak U.S. labor data and growing Fed rate cut bets lift sentiment.

Via Talk Markets · February 6, 2026

The S&P 500 is now down in 2026, and two of the eleven sectors are up by double digits.

Via Talk Markets · February 6, 2026

Bitcoin is back in the headlines after the world’s largest cryptocurrency tumbled sharply on Thursday, briefly slipping below $61,000.

Via Talk Markets · February 6, 2026

After plummeting from $73,000 to $60,000, panic is sweeping the market.

Via Talk Markets · February 6, 2026

The company adds significant capital from a healthcare institution fund while making meaningful regulatory progress on novel therapeutic candidate.

Via Talk Markets · February 6, 2026

Despite short-term exhaustion, USD/JPY remains in a strong uptrend, with interest rate differentials favoring buyers on pullbacks toward key support zones.

Via Talk Markets · February 6, 2026

Amazon stock slides 8% premarket as AI spending concerns grow

Via Talk Markets · February 6, 2026

We live in an era of momentum investing. Value investing – especially deep value investing – is out of fashion. As a result, nobody is interested in PayPal.

Via Talk Markets · February 6, 2026

Gold on Friday was at 4800 USD per troy ounce. It remains in a vulnerable position after declining 3.8% the day before and is moving towards its second consecutive weekly drawdown.

Via Talk Markets · February 6, 2026

Crypto markets have been back in the spotlight on a global scale as losses have intensified in recent days.

Via Talk Markets · February 6, 2026

European markets are in a largely upbeat mood this morning despite the volatility that has been evident across the spectrum of financial assets this week.

Via Talk Markets · February 6, 2026

The yen has been weakening this week, with the USDJPY once again trending towards levels that have sparked intervention in the past.

Via Talk Markets · February 6, 2026

The stress observed in cryptocurrencies and silver is not a mere epiphenomenon: it is the first sign of a market regime that is beginning to strain beneath the surface.

Via Talk Markets · February 6, 2026

December's retail sales and industrial data were disappointing – but we think a potential upturn is closer than ever.

Via Talk Markets · February 6, 2026

Bitcoin faced a severe downturn on Thursday, as its value plunged beneath the $65,000 threshold, briefly touching $60,000 in late trading.

Via Talk Markets · February 6, 2026

The BSE Sensex closed higher by 266 points (up 0.3%)..Meanwhile, the NSE Nifty closed 50 points higher (up 0.2%).

Via Talk Markets · February 6, 2026

Amazon reported its earnings, and traders responded with a nasty sell-off.

Via Talk Markets · February 6, 2026

Bitcoin dropped below $70,000 for the first time since October 2024, losing about a quarter of its value since the start of the year amid a massive reduction in speculative positions across the risk asset spectrum.

Via Talk Markets · February 6, 2026

As the geopolitical map of South American oil shifts in early 2026, the contrast between Guyana and Venezuela has never been starker.

Via Talk Markets · February 6, 2026

The Pound Sterling bounces back against its major currency peers, recovering some of the previous day’s losses.

Via Talk Markets · February 6, 2026

Gold remains volatile after testing $5,000, with $4,800 acting as support as traders await a decisive close to confirm the uptrend’s next phase.

Via Talk Markets · February 6, 2026

Growth stocks have become significantly cheaper since the beginning of the year, and at some point will provide a compelling entry point to add to holdings.

Via Talk Markets · February 6, 2026

Widespread financial meltdown continued again today, slamming crypto, silver, and private credit particularly hard.

Via Talk Markets · February 6, 2026

Markets open with FX largely steady and sterling firmer, but renewed weakness in US labor data has rattled risk sentiment.

Via Talk Markets · February 6, 2026

What was noticeable yesterday was that US interest rates did seem to react to some softer labor market data.

Via Talk Markets · February 6, 2026

Indian share markets are trading lower, with the Sensex trading 268 points lower, and the Nifty is trading 101 points lower.

Via Talk Markets · February 6, 2026

German industrial production disappointed at the end of the year, but this is only a temporary halt, not a new downward trend. An industrial upswing is clearly in the making

Via Talk Markets · February 6, 2026

AUD/CAD remains in the positive territory after recovering its daily losses, trading around 0.9520 during the European hours on Friday.

Via Talk Markets · February 6, 2026

In this video, Ira Epstein covers the recent turmoil in the metals and stock markets, highlighting significant declines such as silver reaching $64 an ounce and gold dropping $1,000 from its peak.

Via Talk Markets · February 6, 2026

The Indian Rupee (INR) trades lower against the US Dollar (USD) during afternoon trading hours in India on Friday.

Via Talk Markets · February 6, 2026

The USD/CAD pair trades with mild losses near 1.3685 during the early European session on Friday. The US Dollar softens against the Canadian Dollar amid weaker-than-expected US economic data and a rise in crude oil prices.

Via Talk Markets · February 6, 2026

Market indexes scuba-dived today: went below the surface and stayed there, across the board. Bitcoin, metals and apparently equities are all being painted with the same quivering-hand brush.

Via Talk Markets · February 5, 2026

Alphabet reported fourth-quarter and full year results that exceeded expectations, with revenue climbing 18% and annual sales surpassing $400 billion for the first time.

Via Talk Markets · February 5, 2026

HOOD transformed from an upstart stock-trading app that became famous in the early months of Covid into an S&P 500 giant and a direct competitor to Fidelity and other online brokerages.

Via Talk Markets · February 5, 2026