Teucrium Agricultural Fund ETV (TAGS)

23.02

+0.00 (0.00%)

NYSE · Last Trade: Jan 26th, 9:04 AM EST

Detailed Quote

| Previous Close | 23.02 |

|---|---|

| Open | - |

| Day's Range | N/A - N/A |

| 52 Week Range | 22.56 - 27.13 |

| Volume | 120 |

| Market Cap | 83.43K |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 2,945 |

Chart

News & Press Releases

Via Benzinga · July 3, 2025

Teucrium Trading, LLC, the Sponsor of agricultural futures-based ETFs, today announced that it will provide white label ETF launch, sub-advisory, and marketing services for established and emerging ETF issuers.

By Teucrium Trading, LLC · Via Business Wire · August 17, 2022

The latest developments of the Russia-Ukraine geopolitical situation may slow down production activities and have an impact on the exporting of commodities and goods. A surge in the prices of crude oil, natural gas, and metals has already been seen.

Via Talk Markets · February 26, 2022

From tin to coffee and crude oil, a lack of supplies is creating a bull market in some commodities.

Via Talk Markets · January 19, 2022

We told clients a few weeks ago to buy soybeans based on the South American drought we saw coming, but why can't wheat prices rally? How weather is affecting the grains market.

Via Talk Markets · January 6, 2022

Frosts for Brazil coffee floods in Germany to their wheat crop, and Midwest weather volatile for corn and soybeans is the weather forecasting

Via Talk Markets · July 23, 2021

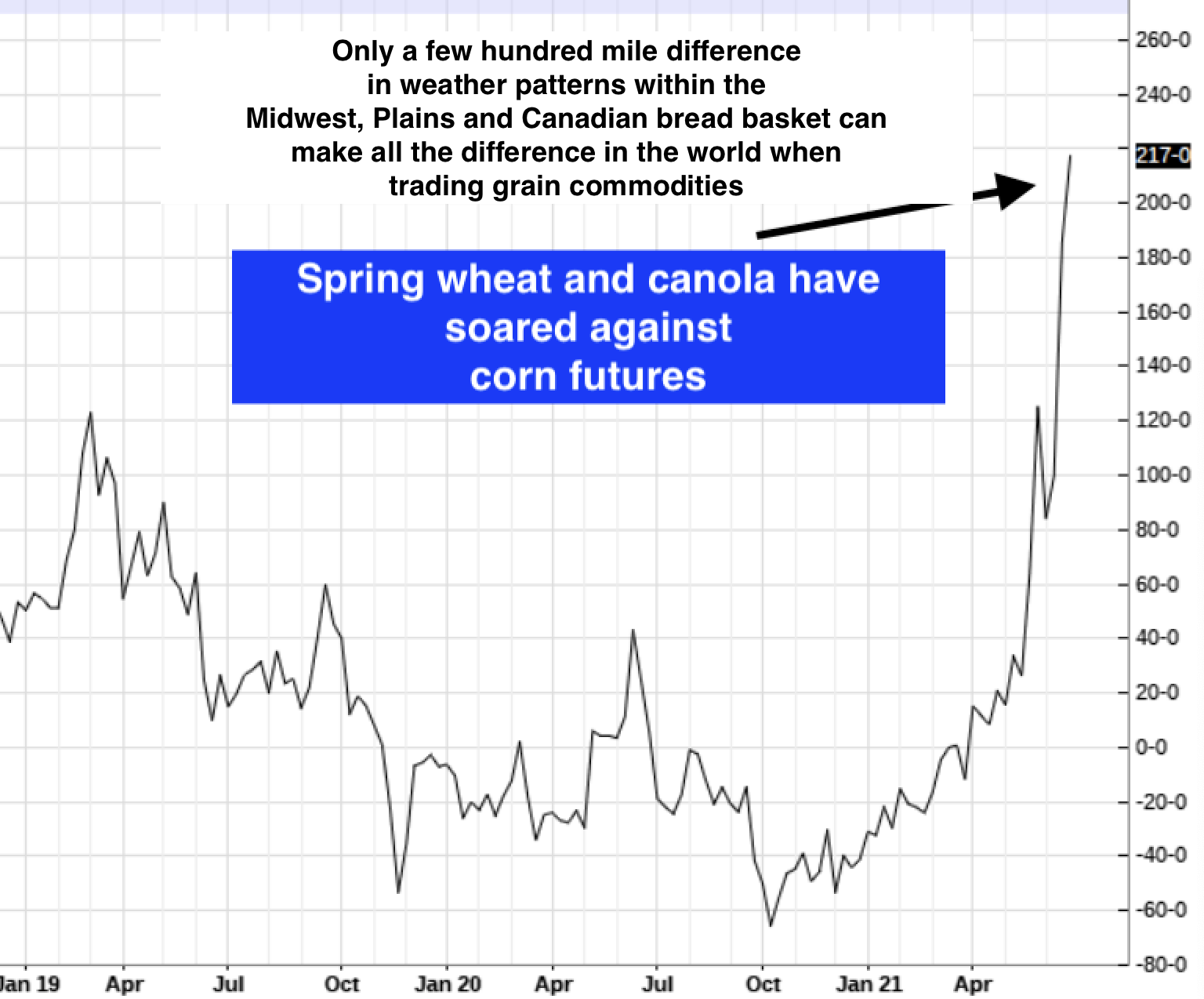

A look at the collapse in corn prices. Canadian Canola and U.S. spring wheat areas are a totally different story.

Via Talk Markets · July 9, 2021

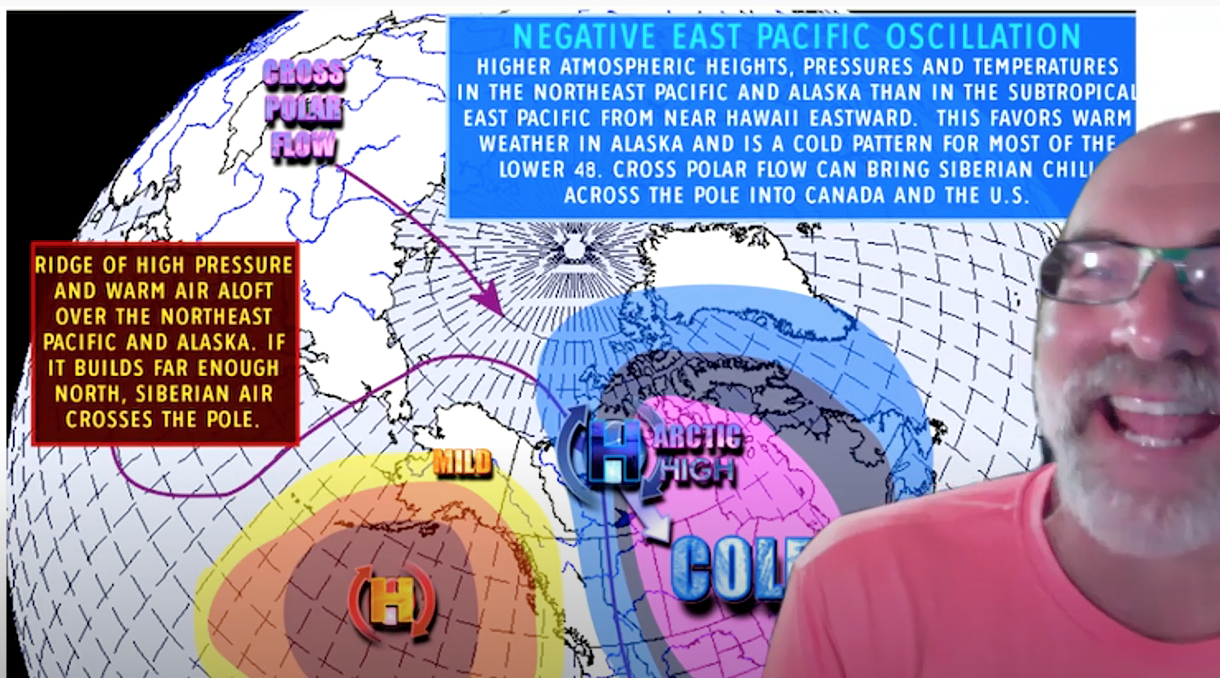

A discussion on how we called the bull move, quite early, in both the natural gas and spring wheat markets and what to look for regarding grain belt weather this summer.

Via Talk Markets · June 29, 2021

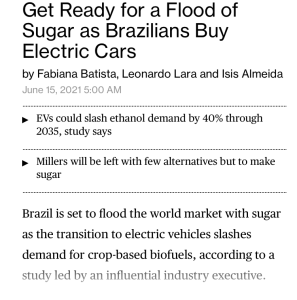

A discussion about the recent Brazil drought and higher crude prices, which have helped sugar prices. However, both India and Thailand's weather and crop production will be important factors in the months ahead for price action.

Via Talk Markets · June 15, 2021

Via Talk Markets · June 12, 2021

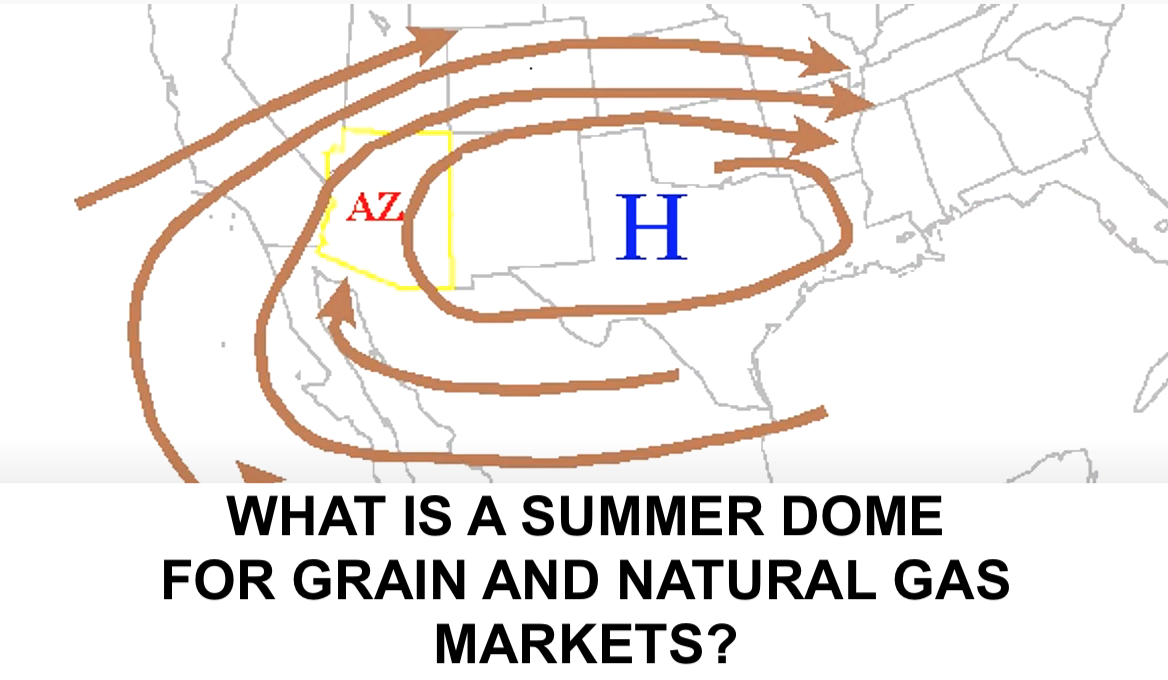

A dome or high-pressure ridge in Meteorology is a key feature in affecting corn, soybean, and natural trading in summer.

Via Talk Markets · June 8, 2021

Investors could easily make some profit from surging food prices through a number of ETFs or ETNs with lower risk. Any of these products could make for a good choice if the current trends continue.

Via Talk Markets · June 3, 2021

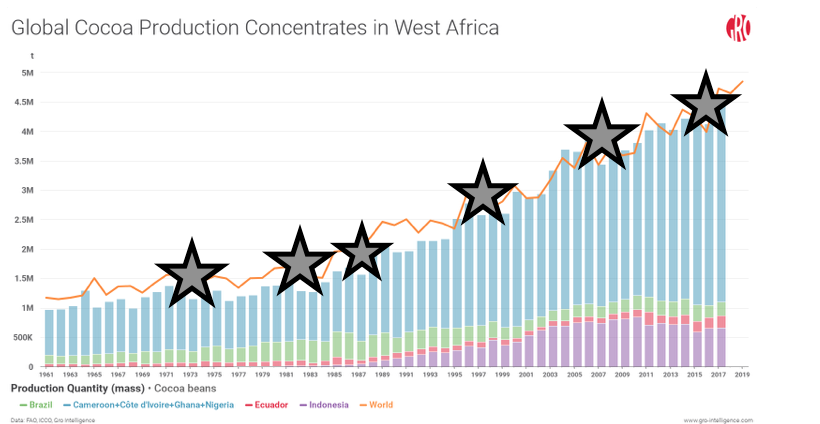

The world is addicted to chocolate. That is nothing new. One of the few commodities not to stage a bull market the last few months has been cocoa. This video discusses the reasons why.

Via Talk Markets · May 25, 2021

Strong Chinese demand, historically tight grain stocks, and global weather problems are creating a supercycle in commodities.

Via Talk Markets · April 27, 2021

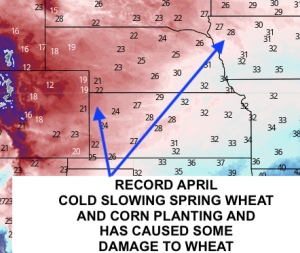

A historical late April cold snap and drought in Brazil have caused another explosion in grain prices.

Via Talk Markets · April 20, 2021