iShares TIPS Bond ETF (TIP)

110.92

+0.02 (0.02%)

NYSE · Last Trade: Nov 11th, 1:05 AM EST

Markets fear Fed independence threatened by ousting of Lisa Cook and potential for more dovish board members, causing volatility in bond ETFs

Via Benzinga · August 26, 2025

Investors anticipate Trumpflation as President Trump's inflation-stoking policies, including tariffs and deficit spending, may drive up costs and impact markets.

Via Benzinga · July 30, 2025

From hawk to dove? Federal Reserve Governor Christopher Waller's words send ETF sectors into speculation mode.

Via Benzinga · June 20, 2025

BlackRock is "overweight" inflation-linked bonds, signaling a strategic shift to mitigate risks stemming from persistent inflation pressure.

Via Benzinga · May 20, 2025

TIPS ETFs have fallen due to easing inflation expectations and rising sovereign risk. Outlook is weak unless inflation or bond turmoil increases.

Via Benzinga · May 19, 2025

State Street Global Advisors' ETFs in Focus report shows disagreement between advisors and retail investors on portfolio risk. ETFs bridge the gap.

Via Benzinga · May 16, 2025

President Trump’s latest announcement on tariffs is a reminder that macro uncertainty is high and will probably remain so for the near term.

Via Talk Markets · March 27, 2025

Rising inflation expectations may limit Fed's rate cuts this year, as they may become self-fulfilling. And consumers are genuinely worried.

Via Benzinga · March 26, 2025

The current volatility in stocks sets up a buying opportunity in bonds; here are three bond ETFs that capitalize on the potential for higher bond prices

Via MarketBeat · March 10, 2025

Portfolio Strategist George Smith advocates for a recalibrated asset allocation strategy due to a slowing-growth environment, elevated inflation, and a 'higher-for-longer' interest rate outlook.

Via Benzinga · February 20, 2025

China’s trade surplus in goods continues to rise and now dwarfs the heights for Germany and Japan during their exporting heydays in the 1990s.

Via Talk Markets · February 18, 2025

Investors shifting expectations for Fed rate cuts as inflation concerns rise and trade tensions escalate. Markets see 1 cut, not 2, by year-end.

Via Benzinga · February 10, 2025

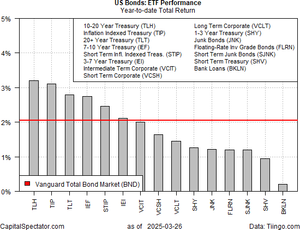

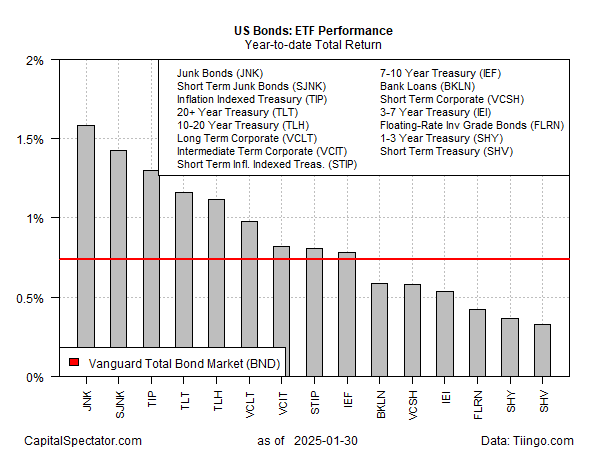

Several risk factors could end the bond market’s party, but for the moment US fixed-income markets are having a good year so far.

Via Talk Markets · January 31, 2025

Via Talk Markets · January 18, 2025

Inflation has the potential to erode investment portfolios—three ETFs may help investors to protect against a potential increase in inflation in 2025.

Via MarketBeat · December 28, 2024

The Federal Reserve's final meeting of the year has historically caused significant moves in 20 ETFs. A rate cut is expected, but the focus is on the Fed's forward guidance and projections.

Via Benzinga · December 18, 2024

Inflationary situation in the U.S. has polarized economists and market watchers even as the Fed is convinced pricing pressure is on a sustainable downward trajectory.

Via Benzinga · September 26, 2024

Recent weak growth data and benign inflation data has sealed the fate of the Fed rate cut but economists hold a mixed view on the policy outcome.

Via Benzinga · September 17, 2024

The markets seemed to be screaming over this past week, especially the bond market. In this video, I take a look at the bond market's price action.

Via Talk Markets · September 14, 2024

A little number-crunching reveals the nation's Social Security beneficiaries are slowly but surely losing buying power.

Via The Motley Fool · August 19, 2024

The recent spare of soft data have raised market expectations of a rate cut in September but not all are convinced regarding that.

Via Benzinga · August 11, 2024

Investors were overall net purchasers of fund assets (including both conventional funds and ETFs) for the eighth week in 10, adding a net $14.3 billion.

Via Talk Markets · July 3, 2024

Last week brought cheer on inflation front with a key data showing that pricing pressure fell to the lowest in three years.

Via Benzinga · June 30, 2024

Larry Summers says Trump's unrealistic fiscal policy proposal, reported in the media last week, poses a significant threat to the economy.

Via Benzinga · June 16, 2024

After CNBC reported that presumptive Republican presidential candidate Donald Trump is considering replacing income taxes in the U.S. with additional import tariffs to offset the revenue shortfall, Nobel laureate and economist Paul Krugman shared his views on the matter through a series of posts on X, formerly known as Twitter, on Thursday.

Via Benzinga · June 14, 2024